Cleaning Summary: Treasury Bond Returns#

import sys

from pathlib import Path

sys.path.insert(0, "../../src")

sys.path.insert(0, "./src")

import calc_treasury_bond_returns

import pandas as pd

# import polars as pl

from he_kelly_manela import pull_he_kelly_manela

from settings import config

DATA_DIR = Path(config("DATA_DIR"))

Treasury Bond Returns Summary#

By leveraging the TRACE dataset from openbondassetpricing.com, the FTSFR dataset ensures a robust foundation for analyzing treasury bond returns, adhering to established methodologies and incorporating comprehensive data cleaning procedures.

Data Cleaning and Construction#

The treasury bond returns dataset is constructed using the following cleaning and processing steps:

1. Bond Selection Criteria#

CUSIP Filtering:

Only include bonds with CUSIPs starting with ‘91’ (indicating Treasury securities)

This ensures we’re only analyzing genuine Treasury bonds

2. Return Processing#

Return Conversion:

Convert raw returns to decimal form by dividing by 100

This standardizes the return format for analysis

Return Filtering:

Remove observations where returns exceed 50% (tr_return > 0.5)

This eliminates potential data errors or extreme outliers

3. Maturity Grouping#

Maturity Bins:

Create 10 maturity groups using 0.5-year intervals from 0 to 5 years

Bins: [0.0, 0.5, 1.0, …, 5.0]

Each group represents a specific maturity range for analysis

Group Assignment:

Assign each bond to a maturity group based on its time to maturity (tau)

Drop observations with missing maturity information

Convert group labels to integers for easier analysis

4. Portfolio Construction#

Return Aggregation:

Group bonds by date and maturity group

Calculate mean returns for each group

This creates a time series of portfolio returns for each maturity group

5. Data Quality Checks#

Missing Value Handling:

Remove observations with missing returns

Remove observations with missing maturity group assignments

Outlier Treatment:

Extreme returns (>50%) are filtered out

This ensures the analysis focuses on normal market conditions

This cleaning process ensures a high-quality dataset for analyzing Treasury bond returns across different maturity groups, facilitating comparison with the Kelly-Manzello data.

hkm = pull_he_kelly_manela.load_he_kelly_manela_all(

data_dir=DATA_DIR / "he_kelly_manela"

)

treas_hkm = hkm.iloc[:, 34:44].copy()

treas_hkm["yyyymm"] = hkm["yyyymm"]

treas_hkm.head()

treas_hkm.tail()

treas_hkm.describe()

treas_hkm.isnull().sum()

US_bonds_01 25

US_bonds_02 25

US_bonds_03 25

US_bonds_04 25

US_bonds_05 25

US_bonds_06 25

US_bonds_07 25

US_bonds_08 25

US_bonds_09 25

US_bonds_10 25

yyyymm 0

dtype: int64

treas_bond_returns = calc_treasury_bond_returns.calc_returns(

data_dir=DATA_DIR / "us_treasury_returns"

)

treas_bond_returns.describe()

| DATE | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 668 | 668.000000 | 668.000000 | 668.000000 | 665.000000 | 665.000000 | 665.000000 | 668.000000 | 668.000000 | 665.000000 | 659.000000 |

| mean | 1997-11-14 12:25:52.095808384 | 0.003809 | 0.004242 | 0.004447 | 0.004466 | 0.004474 | 0.004838 | 0.005006 | 0.005152 | 0.005141 | 0.005120 |

| min | 1970-01-31 00:00:00 | -0.000283 | -0.008939 | -0.025195 | -0.032362 | -0.046647 | -0.052993 | -0.052765 | -0.060457 | -0.058666 | -0.059056 |

| 25% | 1983-12-23 06:00:00 | 0.001228 | 0.000874 | 0.000446 | 0.000224 | -0.000375 | -0.000747 | -0.001473 | -0.002057 | -0.002714 | -0.003201 |

| 50% | 1997-11-15 00:00:00 | 0.003798 | 0.003604 | 0.003525 | 0.003321 | 0.003453 | 0.003900 | 0.004090 | 0.004340 | 0.004370 | 0.004511 |

| 75% | 2011-10-07 18:00:00 | 0.005326 | 0.006152 | 0.007166 | 0.007829 | 0.008772 | 0.010052 | 0.011202 | 0.012094 | 0.012924 | 0.013117 |

| max | 2025-08-31 00:00:00 | 0.023142 | 0.045551 | 0.064735 | 0.068330 | 0.091789 | 0.095415 | 0.086319 | 0.093149 | 0.093774 | 0.121050 |

| std | NaN | 0.003098 | 0.004619 | 0.006256 | 0.007471 | 0.008891 | 0.010458 | 0.011638 | 0.012975 | 0.013851 | 0.014982 |

Comparing FTSFR with He Kelly Manela#

# Print initial data info

print("Treasury Bond Returns Info:")

print(treas_bond_returns.info())

print("\nTreasury Bond Returns Head:")

print(treas_bond_returns.head())

print("\nTreasury Bond Returns Date Range:")

print(treas_bond_returns["DATE"].min(), "to", treas_bond_returns["DATE"].max())

print("\nHKM Treasury Bonds Info:")

print(treas_hkm.info())

print("\nHKM Treasury Bonds Head:")

print(treas_hkm.head())

# Convert treas_hkm dates to datetime

treas_hkm["date"] = pd.to_datetime(

treas_hkm["yyyymm"].astype(int).astype(str), format="%Y%m"

) + pd.offsets.MonthEnd(0)

print("\nAfter date conversion - HKM Treasury Bonds Head:")

print(treas_hkm.head())

print("\nHKM Treasury Bonds Date Range:")

print(treas_hkm["date"].min(), "to", treas_hkm["date"].max())

# Convert treas_bond_returns DATE to datetime if it's not already

treas_bond_returns["DATE"] = pd.to_datetime(treas_bond_returns["DATE"])

print("\nAfter date conversion - Treasury Bond Returns Head:")

print(treas_bond_returns.head())

print("\nTreasury Bond Returns Date Range:")

print(treas_bond_returns["DATE"].min(), "to", treas_bond_returns["DATE"].max())

# Try the merge

merged_df = pd.merge(

treas_bond_returns, treas_hkm, left_on="DATE", right_on="date", how="inner"

)

print("\nMerged DataFrame Shape:", merged_df.shape)

print("\nMerged DataFrame Head:")

print(merged_df.head())

# Create subplots for each pair of columns

import matplotlib.pyplot as plt

if not merged_df.empty:

fig, axes = plt.subplots(5, 2, figsize=(15, 20))

axes = axes.flatten()

for i in range(10):

col1 = str(i + 1) # Column from treas_bond_returns

if i == 9:

col2 = "US_bonds_10" # Column from treas_hkm

else:

col2 = f"US_bonds_0{i + 1}" # Column from treas_hkm

ax = axes[i]

ax.plot(

merged_df["DATE"], merged_df[col1], label=f"Portfolio {i + 1}", color="blue"

)

ax.plot(

merged_df["DATE"],

merged_df[col2],

label=f"HKM {i + 1}",

color="red",

linestyle="--",

)

ax.set_title(f"Comparison: Portfolio {i + 1} vs HKM {i + 1}")

ax.legend()

ax.grid(True)

# Rotate x-axis labels for better readability

plt.setp(ax.get_xticklabels(), rotation=45)

plt.tight_layout()

plt.show()

else:

print("\nNo data to plot - merged DataFrame is empty")

# Print correlation between corresponding columns

print("\nCorrelations between corresponding columns:")

for i in range(10):

col1 = str(i + 1)

if i == 9:

col2 = "US_bonds_10"

else:

col2 = f"US_bonds_0{i + 1}"

corr = merged_df[col1].corr(merged_df[col2])

print(f"Portfolio {i + 1} vs HKM {i + 1}: {corr:.4f}")

Treasury Bond Returns Info:

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 668 entries, 0 to 667

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 DATE 668 non-null datetime64[ns]

1 1 668 non-null float64

2 2 668 non-null float64

3 3 668 non-null float64

4 4 665 non-null float64

5 5 665 non-null float64

6 6 665 non-null float64

7 7 668 non-null float64

8 8 668 non-null float64

9 9 665 non-null float64

10 10 659 non-null float64

dtypes: datetime64[ns](1), float64(10)

memory usage: 57.5 KB

None

Treasury Bond Returns Head:

DATE 1 2 3 4 5 6 \

0 1970-01-31 0.008027 0.008752 0.006678 0.008800 0.010397 0.007652

1 1970-02-28 0.008731 0.015935 0.016617 0.023389 0.028954 NaN

2 1970-03-31 0.006317 0.007638 0.007676 0.009226 0.009374 NaN

3 1970-04-30 0.004571 0.000628 -0.002641 -0.005875 -0.009144 NaN

4 1970-05-31 0.004894 0.006297 0.005494 0.004096 0.004789 0.009457

7 8 9 10

0 -0.006523 0.010780 0.009950 0.002499

1 0.026928 0.040144 0.043813 0.035437

2 0.009485 0.007844 0.007447 0.008757

3 -0.015769 -0.015136 -0.018791 -0.020009

4 0.008328 0.008393 0.010475 0.010748

Treasury Bond Returns Date Range:

1970-01-31 00:00:00 to 2025-08-31 00:00:00

HKM Treasury Bonds Info:

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 516 entries, 0 to 515

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 US_bonds_01 491 non-null float64

1 US_bonds_02 491 non-null float64

2 US_bonds_03 491 non-null float64

3 US_bonds_04 491 non-null float64

4 US_bonds_05 491 non-null float64

5 US_bonds_06 491 non-null float64

6 US_bonds_07 491 non-null float64

7 US_bonds_08 491 non-null float64

8 US_bonds_09 491 non-null float64

9 US_bonds_10 491 non-null float64

10 yyyymm 516 non-null float64

dtypes: float64(11)

memory usage: 44.5 KB

None

HKM Treasury Bonds Head:

US_bonds_01 US_bonds_02 US_bonds_03 US_bonds_04 US_bonds_05 \

0 NaN NaN NaN NaN NaN

1 NaN NaN NaN NaN NaN

2 NaN NaN NaN NaN NaN

3 NaN NaN NaN NaN NaN

4 NaN NaN NaN NaN NaN

US_bonds_06 US_bonds_07 US_bonds_08 US_bonds_09 US_bonds_10 yyyymm

0 NaN NaN NaN NaN NaN 197001.0

1 NaN NaN NaN NaN NaN 197002.0

2 NaN NaN NaN NaN NaN 197003.0

3 NaN NaN NaN NaN NaN 197004.0

4 NaN NaN NaN NaN NaN 197005.0

After date conversion - HKM Treasury Bonds Head:

US_bonds_01 US_bonds_02 US_bonds_03 US_bonds_04 US_bonds_05 \

0 NaN NaN NaN NaN NaN

1 NaN NaN NaN NaN NaN

2 NaN NaN NaN NaN NaN

3 NaN NaN NaN NaN NaN

4 NaN NaN NaN NaN NaN

US_bonds_06 US_bonds_07 US_bonds_08 US_bonds_09 US_bonds_10 yyyymm \

0 NaN NaN NaN NaN NaN 197001.0

1 NaN NaN NaN NaN NaN 197002.0

2 NaN NaN NaN NaN NaN 197003.0

3 NaN NaN NaN NaN NaN 197004.0

4 NaN NaN NaN NaN NaN 197005.0

date

0 1970-01-31

1 1970-02-28

2 1970-03-31

3 1970-04-30

4 1970-05-31

HKM Treasury Bonds Date Range:

1970-01-31 00:00:00 to 2012-12-31 00:00:00

After date conversion - Treasury Bond Returns Head:

DATE 1 2 3 4 5 6 \

0 1970-01-31 0.008027 0.008752 0.006678 0.008800 0.010397 0.007652

1 1970-02-28 0.008731 0.015935 0.016617 0.023389 0.028954 NaN

2 1970-03-31 0.006317 0.007638 0.007676 0.009226 0.009374 NaN

3 1970-04-30 0.004571 0.000628 -0.002641 -0.005875 -0.009144 NaN

4 1970-05-31 0.004894 0.006297 0.005494 0.004096 0.004789 0.009457

7 8 9 10

0 -0.006523 0.010780 0.009950 0.002499

1 0.026928 0.040144 0.043813 0.035437

2 0.009485 0.007844 0.007447 0.008757

3 -0.015769 -0.015136 -0.018791 -0.020009

4 0.008328 0.008393 0.010475 0.010748

Treasury Bond Returns Date Range:

1970-01-31 00:00:00 to 2025-08-31 00:00:00

Merged DataFrame Shape: (516, 23)

Merged DataFrame Head:

DATE 1 2 3 4 5 6 \

0 1970-01-31 0.008027 0.008752 0.006678 0.008800 0.010397 0.007652

1 1970-02-28 0.008731 0.015935 0.016617 0.023389 0.028954 NaN

2 1970-03-31 0.006317 0.007638 0.007676 0.009226 0.009374 NaN

3 1970-04-30 0.004571 0.000628 -0.002641 -0.005875 -0.009144 NaN

4 1970-05-31 0.004894 0.006297 0.005494 0.004096 0.004789 0.009457

7 8 9 ... US_bonds_03 US_bonds_04 US_bonds_05 \

0 -0.006523 0.010780 0.009950 ... NaN NaN NaN

1 0.026928 0.040144 0.043813 ... NaN NaN NaN

2 0.009485 0.007844 0.007447 ... NaN NaN NaN

3 -0.015769 -0.015136 -0.018791 ... NaN NaN NaN

4 0.008328 0.008393 0.010475 ... NaN NaN NaN

US_bonds_06 US_bonds_07 US_bonds_08 US_bonds_09 US_bonds_10 yyyymm \

0 NaN NaN NaN NaN NaN 197001.0

1 NaN NaN NaN NaN NaN 197002.0

2 NaN NaN NaN NaN NaN 197003.0

3 NaN NaN NaN NaN NaN 197004.0

4 NaN NaN NaN NaN NaN 197005.0

date

0 1970-01-31

1 1970-02-28

2 1970-03-31

3 1970-04-30

4 1970-05-31

[5 rows x 23 columns]

Correlations between corresponding columns:

Portfolio 1 vs HKM 1: 0.9939

Portfolio 2 vs HKM 2: 0.9996

Portfolio 3 vs HKM 3: 0.9995

Portfolio 4 vs HKM 4: 0.9983

Portfolio 5 vs HKM 5: 0.9960

Portfolio 6 vs HKM 6: 0.9987

Portfolio 7 vs HKM 7: 0.9982

Portfolio 8 vs HKM 8: 0.9988

Portfolio 9 vs HKM 9: 0.9953

Portfolio 10 vs HKM 10: 0.9975

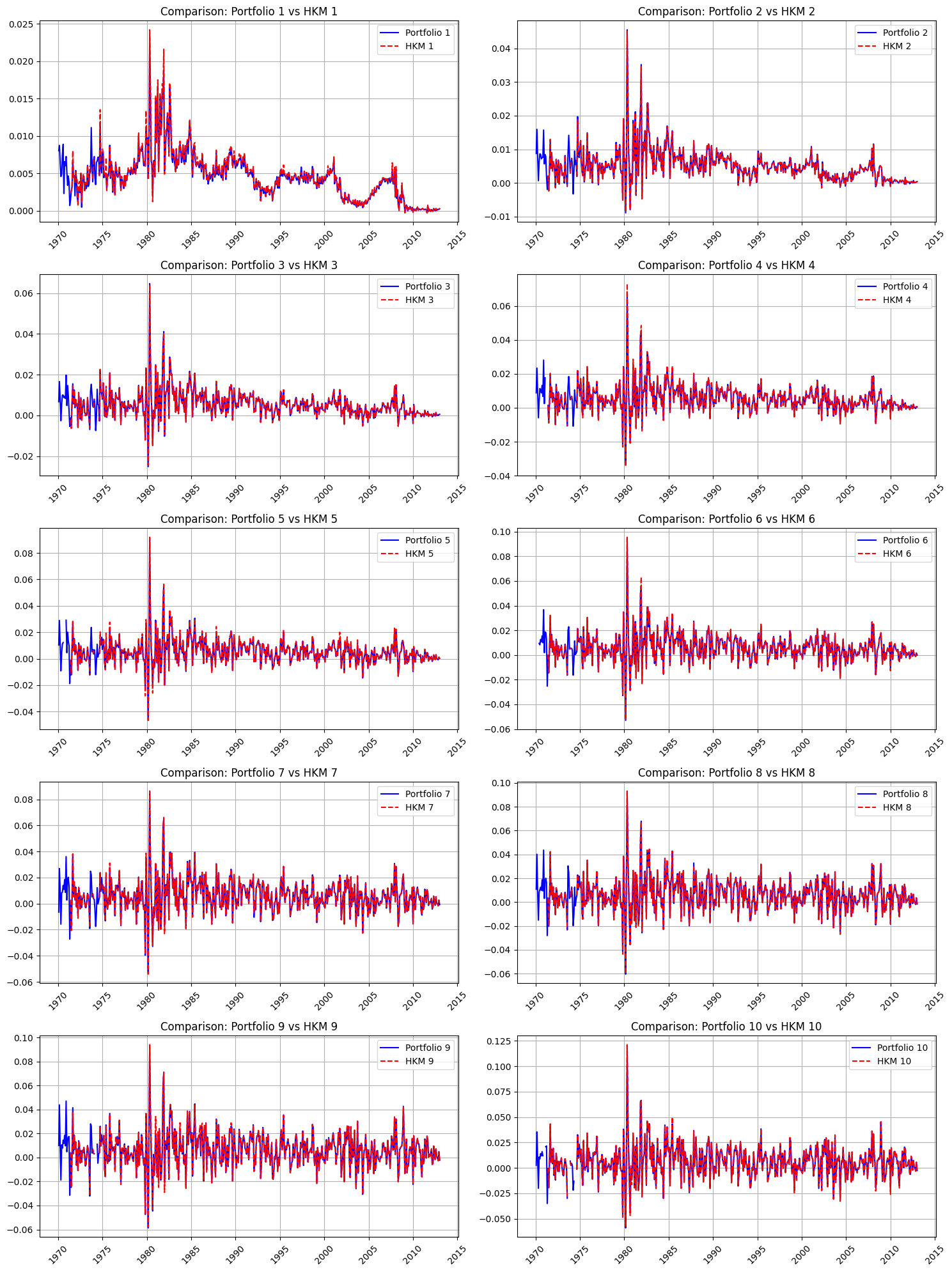

📈 Comparison of Treasury Bond Portfolio Returns: FTSFR Portfolios vs. HKM Portfolios#

The figure above compares the time-series returns of Treasury bond portfolios:

Portfolios 1–10 (in blue): Portfolios constructed by FTSFR, where Treasury bonds are sorted by time remaining to maturity, in 6-month intervals:

Portfolio 1: 0 to 6 months

Portfolio 2: 6 months to 1 year

Portfolio 3: 1 year to 1.5 years

Portfolio 4: 1.5 to 2 years

Portfolio 5: 2 to 2.5 years

Portfolio 6: 2.5 to 3 years

Portfolio 7: 3 to 3.5 years

Portfolio 8: 3.5 to 4 years

Portfolio 9: 4 to 4.5 years

Portfolio 10: 4.5 to 5 years

HKM Portfolios 1–10 (in red): Portfolios from He, Kelly, and Manella (HKM) using a similar 6-month maturity bucket structure for comparison.

🔍 Observations#

The returns between FTSFR portfolios (blue) and HKM portfolios (red) show close alignment, indicating a consistent term-structure pattern across both datasets.

During periods of heightened volatility—such as the 2008 financial crisis —portfolios with longer time to maturity generally exhibit greater return sensitivity, seen consistently in both series.

Small return differences may result from:

Rounding errors due to different data sources and small values.

Missing values in the HKM data.

This comparison confirms that the FTSFR replication tracks the structure and return behavior of the HKM maturity-sorted Treasury portfolios.