Cleaning Summary: CDS Bond Basis#

Paper Introduction#

This construction is based upon the structure proposed by Siriwardane, Sunderam, and Wallen in Segmented Arbitrage (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3960980). The original paper studies the concept of implied arbitrage returns in many different markets. If markets were truly frictionless, we would expect there to be perfect correlation between all of the arbitrage returns. This is because efficient capital allocation would dictate that capital be spent where the best opportunity is, thus dictating the arbitrage opportunites we calculate via different product would have correlating rates as capital would be allocated to a different source if the arbitrage opportunity looks more attractive.

CDS Par Spread Returns#

Spread Construction#

In the following notebook, we will walk through the steps to constructing the implied arbitrage found in the CDS and corporate bond market as specified in the Appendix of the paper (https://static1.squarespace.com/static/5e29e11bb83a3f5d75beb17d/t/654d74d916f20316049a0889/1699575002123/Appendix.pdf). The authors define the CDS basis (\(CB\)) as

where:

\(FR_{i, t, \tau}\) = time \(t\) floating rate spread implied by a fixed-rate corporate bond issued by firm \(i\) at tenor \(\tau\)

\(CDS_{i, t, \tau}\) = time \(t\) Credit Default Swap (CDS) par spread for firm \(i\) with tenor \(\tau\)

A negative basis implies an investor could earn a positive arbitrage profit by going long the bond and purchasing CDS protection. The investor would pay a lower par spread than the coupon of the bond itself and then receive value from the default.

The value of \(FR\) is substituted by the paper with Z-spread which we also modify in our construction. We will go into the substitution in detail later.

The value of \(CDS\) is interpolated by the authors using a cubic spline function.

Implied Risk Free Return#

Given the CDS spread from above, traditional construction of a risk free rate for implied arbitrage implied the following return.

where:

\(y_{t, \tau}\) = maturity matched treasury yield at time \(t\)

The risk free rate then can be seen as the treasury yield in addition to the basis recieved when executing the CDS basis trade (investor benefits from negative basis).

Key Filters when selecting viable data as specified in Segmented Arbitrage#

Include only Senior Unsecured Debt issued in USD by US firms with valid ISIN

Include only fixed rate bonds with maturity between 1 and 10 years

Include only bonds with outstanding principle of at least 100,000 USD

Exclude putable and convertible bonds

Exclude bonds trading at less than half of face value

Include only assets on a certain date if a cubic spline of the CDS set is possible

There must be 2 or more CDS products corresponding to a corporate bond on a certain day for parspread cubic spline to be possible

import sys

from pathlib import Path

sys.path.insert(0, "../../src")

sys.path.insert(0, "./src")

import pandas as pd

import pull_open_source_bond

import pull_wrds_markit

from merge_cds_bond import *

from process_final_product import *

from settings import config

# %load_ext autoreload

# %autoreload 2

DATA_DIR = Path(config("DATA_DIR"))

Z-Spread (Zero-Volatility Spread)#

Mathematical definition

For a bond with cash-flows \(CF_t\) at times \(t=1,\dots,N\) and Treasury spot rates \(s_t\),

The constant \(Z\) that solves this equation is the Z-spread.

Intuition

\(Z\) is the uniform extra yield added to every point on the risk-free spot curve so that the discounted cash-flows equal the bond’s dirty price \(P\). It compensates investors for credit and liquidity risk relative to Treasuries.

Link to Yield-to-Maturity#

Setting the Z-spread pricing equation equal to the standard YTM equation gives

where \(y\) is the bond’s yield-to-maturity. Except for the trivial flat-curve case (\(s_t=s\)), (A1) has no algebraic solution—\(y\) or \(Z\) must be found numerically.

Continuous-Compounding Identity#

Rewrite discounts as \(e^{-r t}\). With PV-weights

equation (A1) yields the convenient mean-value relationship

Thus YTM is the PV-weighted average of the spot rates plus the Z-spread.

Practical Proxy: YTM Credit Spread#

Analysts often approximate \(Z\) with the credit spread

where \(y_{\text{Treasury-DM}}\) is the yield on a Treasury portfolio matched to the bond’s (modified) duration.

Why it works

A small parallel shift \(Z\) applied to all discount rates changes price by \(-D_{\text{mod}}\;Z\). For modest spreads, this produces nearly the same price change as replacing the spot curve with a single rate shift \(\Delta y\).

Duration-matching the Treasury benchmark neutralises curve-shape effects, so \(\Delta y\) isolates the average extra yield attributable to credit/liquidity risk.

Empirically, \(\Delta y\) tracks \(Z\) closely for plain-vanilla, option-free bonds, making it a “good-enough” proxy when full spot-curve data or iterative Z-spread calculations are impractical.

Note

Z-spread is said to be populated by Markit in the CDS dataset but during the reconstruction process we found no proxy. Thus, we chose our own construction.

Data Overview#

corp_bonds_data = pull_open_source_bond.load_corporate_bond_returns(

data_dir=DATA_DIR / "cds_bond_basis"

)

red_data = pd.read_parquet(DATA_DIR / "cds_bond_basis" / "RED_and_ISIN_mapping.parquet")

cds_data = pull_wrds_markit.load_cds_data(data_dir=DATA_DIR / "cds_bond_basis")

corp_bonds_data.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1572384 entries, 0 to 1572383

Data columns (total 49 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 date 1572384 non-null datetime64[ns]

1 cusip 1572384 non-null object

2 issuer_cusip 1572384 non-null object

3 permno 1422169 non-null float64

4 exretn_t+1 1041541 non-null float64

5 exretnc_bns_t+1 1030933 non-null float64

6 exretnc_t+1 1038056 non-null float64

7 exretnc_dur_t+1 1038056 non-null float64

8 bond_ret_t+1 1041541 non-null float64

9 bond_ret 1046059 non-null float64

10 exretn 1046059 non-null float64

11 exretnc_bns 1035383 non-null float64

12 exretnc 1042538 non-null float64

13 exretnc_dur 1042538 non-null float64

14 rating 1398323 non-null float64

15 cs 1389316 non-null float64

16 cs_6m_delta 1200967 non-null float64

17 bond_yield 1389838 non-null float64

18 bond_amount_out 1398323 non-null float64

19 offering_amt 1398323 non-null float64

20 bondprc 1188065 non-null float64

21 perc_par 1188065 non-null float64

22 tmt 1398323 non-null float64

23 duration 1389316 non-null float64

24 ind_num_17 1036811 non-null float64

25 sic_code 1398323 non-null float64

26 mom6_1 1468700 non-null float64

27 ltrev48_12 770557 non-null float64

28 BOND_RET 1206499 non-null float64

29 ILLIQ 1137969 non-null float64

30 var95 672058 non-null float64

31 n_trades_month 1212316 non-null float64

32 size_ig 1398323 non-null float64

33 size_jk 1398323 non-null float64

34 zcb 1398323 non-null float64

35 conv 1398323 non-null float64

36 BOND_YIELD 1294588 non-null float64

37 CS 1294588 non-null float64

38 BONDPRC 1294588 non-null float64

39 PRFULL 1294588 non-null float64

40 DURATION 1294588 non-null float64

41 CONVEXITY 1294588 non-null float64

42 CS_6M_DELTA 1084920 non-null float64

43 bond_value 1188065 non-null float64

44 BOND_VALUE 1294585 non-null float64

45 coupon 1572384 non-null float64

46 bond_type 1572384 non-null object

47 principal_amt 1572384 non-null float64

48 bondpar_mil 1398323 non-null float64

dtypes: datetime64[ns](1), float64(45), object(3)

memory usage: 587.8+ MB

As a proxy for the Z-spread, we will use the credit spread between the bond’s yield and the yield on a Treasury portfolio matched to the bond’s (modified) duration. In this data,

“cs” is the market-microstructure-noise-biased credit spread

“CS” is the credit spread that has been adjusted for the market-microstructure noise. We will use this as our proxy for the Z-spread.

“BOND_YIELD” is the corporate bond yield that has been adjusted for market-microstructure noise. We will use “BOND_YIELD” - “CS” as our treasury yield during the period.

corp_bonds_data.describe()

| date | permno | exretn_t+1 | exretnc_bns_t+1 | exretnc_t+1 | exretnc_dur_t+1 | bond_ret_t+1 | bond_ret | exretn | exretnc_bns | ... | BONDPRC | PRFULL | DURATION | CONVEXITY | CS_6M_DELTA | bond_value | BOND_VALUE | coupon | principal_amt | bondpar_mil | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 1572384 | 1.422169e+06 | 1.041541e+06 | 1.030933e+06 | 1.038056e+06 | 1.038056e+06 | 1.041541e+06 | 1.046059e+06 | 1.046059e+06 | 1.035383e+06 | ... | 1.294588e+06 | 1.294588e+06 | 1.294588e+06 | 1.294588e+06 | 1.084920e+06 | 1.188065e+06 | 1.294585e+06 | 1.572384e+06 | 1.572384e+06 | 1.398323e+06 |

| mean | 2013-03-05 13:07:44.259111936 | 5.166780e+04 | 3.282121e-03 | 2.130163e-03 | 2.326617e-03 | 2.529531e-03 | 4.099201e-03 | 4.168516e-03 | 3.349400e-03 | 2.137542e-03 | ... | 1.050217e+02 | 1.063816e+02 | 6.507442e+00 | 8.344123e+01 | -3.073578e-02 | 6.512686e+07 | 6.196192e+07 | 5.730033e+00 | 9.998092e+02 | 5.559556e+02 |

| min | 2002-08-31 00:00:00 | 1.002500e+04 | -9.767108e-01 | -9.788410e-01 | -9.754962e-01 | -9.750838e-01 | -9.753108e-01 | -9.753108e-01 | -9.767108e-01 | -9.788410e-01 | ... | 1.000000e-04 | 1.009944e-01 | 5.683952e-03 | 1.021010e-04 | -1.066395e+01 | 1.500000e+01 | 1.700000e+01 | 0.000000e+00 | 1.000000e+01 | 1.000000e-03 |

| 25% | 2007-12-31 00:00:00 | 2.322900e+04 | -6.494539e-03 | -5.660667e-03 | -6.013460e-03 | -5.673846e-03 | -5.630089e-03 | -5.611824e-03 | -6.479160e-03 | -5.682974e-03 | ... | 9.967818e+01 | 1.005404e+02 | 3.231727e+00 | 1.276730e+01 | -2.339199e-01 | 2.726895e+07 | 2.593350e+07 | 4.200000e+00 | 1.000000e+03 | 2.386430e+02 |

| 50% | 2013-07-31 00:00:00 | 5.627400e+04 | 2.460858e-03 | 1.367245e-03 | 1.515543e-03 | 1.514050e-03 | 3.312874e-03 | 3.337704e-03 | 2.483598e-03 | 1.364946e-03 | ... | 1.042477e+02 | 1.055880e+02 | 5.275024e+00 | 3.381145e+01 | -4.462923e-02 | 4.723913e+07 | 4.368532e+07 | 5.875000e+00 | 1.000000e+03 | 4.000000e+02 |

| 75% | 2018-04-30 00:00:00 | 7.892700e+04 | 1.359472e-02 | 1.012049e-02 | 1.096072e-02 | 1.054284e-02 | 1.441620e-02 | 1.448506e-02 | 1.366403e-02 | 1.013573e-02 | ... | 1.105670e+02 | 1.121482e+02 | 8.567085e+00 | 9.504011e+01 | 1.521478e-01 | 7.836473e+07 | 7.508250e+07 | 7.125000e+00 | 1.000000e+03 | 7.000000e+02 |

| max | 2022-09-30 00:00:00 | 9.343300e+04 | 3.683310e+00 | 3.679218e+00 | 1.093704e+00 | 1.026469e+00 | 3.683510e+00 | 3.683510e+00 | 3.683310e+00 | 3.679218e+00 | ... | 8.491486e+03 | 8.491486e+03 | 3.546374e+01 | 1.346690e+03 | 7.585604e+00 | 1.899989e+09 | 1.908028e+09 | 1.650000e+01 | 1.000000e+03 | 1.500000e+04 |

| std | NaN | 2.817581e+04 | 4.198366e-02 | 4.125521e-02 | 4.183619e-02 | 4.056453e-02 | 4.193871e-02 | 4.217267e-02 | 4.221634e-02 | 4.147882e-02 | ... | 1.604661e+01 | 1.615361e+01 | 4.342256e+00 | 1.118131e+02 | 4.059461e-01 | 6.674075e+07 | 6.490551e+07 | 2.133292e+00 | 1.374154e+01 | 5.971824e+02 |

8 rows × 46 columns

Step 1: Merge the Redcodes of firms on to the corporate bonds.#

The code for it is in merge_cds_bond.py in the function merge_redcode_into_bond_treas. The more specific inputs are within the function itself.

Given CDS tables record issuers of the Credit Default Swaps using Redcode and the bond tables only had CUSIPs, we needed to conduct a merge using a redcode-CUSIP matching table to the end product of step 1.2 for CDS processing later on.

We will pull the results without processing for CDS implied arbitrage returns.

corp_red_data = merge_red_code_into_bond_treas(corp_bonds_data, red_data)

corp_red_data.head()

| date | cusip | issuer_cusip | BOND_YIELD | CS | size_ig | size_jk | mat_days | redcode | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2013-05-31 | 00101JAE6 | 00101J | 0.021252 | 0.013751 | 1.0 | 1.0 | 1506.0 | 0A119O |

| 1 | 2013-05-31 | 00101JAE6 | 00101J | 0.021252 | 0.013751 | 1.0 | 1.0 | 1506.0 | UU079R |

| 2 | 2013-06-30 | 00101JAE6 | 00101J | 0.026850 | 0.017144 | 1.0 | 1.0 | 1476.0 | 0A119O |

| 3 | 2013-06-30 | 00101JAE6 | 00101J | 0.026850 | 0.017144 | 1.0 | 1.0 | 1476.0 | UU079R |

| 4 | 2013-07-31 | 00101JAE6 | 00101J | 0.023579 | 0.014047 | 1.0 | 1.0 | 1445.0 | 0A119O |

corp_red_data.describe()

| date | BOND_YIELD | CS | size_ig | size_jk | mat_days | |

|---|---|---|---|---|---|---|

| count | 1398784 | 1.252264e+06 | 1.252264e+06 | 1.316230e+06 | 1.316230e+06 | 1.316230e+06 |

| mean | 2013-01-17 01:58:03.485084672 | 4.866752e-02 | 2.608657e-02 | 8.228288e-01 | 9.783617e-01 | 3.761267e+03 |

| min | 2002-08-31 00:00:00 | -7.918977e-01 | -8.427172e-01 | 0.000000e+00 | 0.000000e+00 | 3.610000e+02 |

| 25% | 2008-01-31 00:00:00 | 2.911486e-02 | 9.941452e-03 | 1.000000e+00 | 1.000000e+00 | 1.342000e+03 |

| 50% | 2013-03-31 00:00:00 | 4.339818e-02 | 1.698669e-02 | 1.000000e+00 | 1.000000e+00 | 2.479000e+03 |

| 75% | 2018-01-31 00:00:00 | 5.791579e-02 | 2.852355e-02 | 1.000000e+00 | 1.000000e+00 | 5.522000e+03 |

| max | 2022-09-30 00:00:00 | 2.442612e+01 | 2.441472e+01 | 1.000000e+00 | 1.000000e+00 | 3.652500e+04 |

| std | NaN | 6.505191e-02 | 6.460367e-02 | 3.818136e-01 | 1.454995e-01 | 3.532676e+03 |

Step 2: CDS data pull and CDS data processing#

Step 2.1: CDS data pull#

The CDS data pull will be filtered using the redcodes from the above bond_redcode_merged_data dataframe, ensuring that only the firms that have corporate bond data are pulled from the CDS table. Daily CDS data is being pulled initially,

resulting in a mismatch in amount compared to corporate bonds. The data will be reduced during the merge process as the corporate bonds are indicated by monthly data.

Step 2.2: CDS data processing#

Let’s first observe the data to see what we are working with:

cds_data.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 46851870 entries, 0 to 46851869

Data columns (total 7 columns):

# Column Dtype

--- ------ -----

0 date datetime64[ns]

1 ticker string

2 redcode string

3 parspread Float64

4 tenor string

5 country string

6 year int64

dtypes: Float64(1), datetime64[ns](1), int64(1), string(4)

memory usage: 2.5 GB

cds_data.describe()

| date | parspread | year | |

|---|---|---|---|

| count | 46851870 | 46707717.0 | 4.685187e+07 |

| mean | 2011-12-19 02:04:52.993115392 | 0.021868 | 2.011462e+03 |

| min | 2001-01-02 00:00:00 | 0.000007 | 2.001000e+03 |

| 25% | 2006-12-18 00:00:00 | 0.003602 | 2.006000e+03 |

| 50% | 2010-07-13 00:00:00 | 0.007839 | 2.010000e+03 |

| 75% | 2017-05-02 00:00:00 | 0.018148 | 2.017000e+03 |

| max | 2023-12-29 00:00:00 | 491.842763 | 2.023000e+03 |

| std | NaN | 0.638027 | 6.115298e+00 |

The CDS data has a flaw: the tenor is displayed as opposed to maturity date which would allow for more accurate cubic splines of the par spread. To approximate the correct number of days, we use tenor as is and annualize.

For example, if the tenor is \(3Y\), the number of days that we use to annualize is \(3 \times 365 = 1095\).

In our processing function merge_cds_bond, we grab the redcode, date tuples for which we can generate a viable cubic spline function, filter the bond and treasury dataframe (output of step 1).

Then, we use the days between the maturity and the date for each corporate bond as the input for the cubic spline function for par spread generation. Thus, our final product contains corporate bonds, duration matched treasury rates, and implied

CDS par spreads as specified by the Segmented Arbitrage paper.

final_data = merge_cds_into_bonds(corp_red_data, cds_data)

final_data.head()

| cusip | date | mat_days | BOND_YIELD | CS | size_ig | size_jk | par_spread | |

|---|---|---|---|---|---|---|---|---|

| 39 | 00101JAE6 | 2014-12-31 | 927.0 | 0.033902 | 0.025627 | 1.0 | 1.0 | 0.034591 |

| 45 | 00101JAE6 | 2015-03-31 | 837.0 | 0.026494 | 0.020114 | 1.0 | 1.0 | 0.017713 |

| 47 | 00101JAE6 | 2015-04-30 | 807.0 | 0.024420 | 0.018444 | 1.0 | 1.0 | 0.017103 |

| 51 | 00101JAE6 | 2015-06-30 | 746.0 | 0.026136 | 0.019872 | 1.0 | 1.0 | 0.016516 |

| 53 | 00101JAE6 | 2015-07-31 | 715.0 | 0.022742 | 0.015899 | 1.0 | 1.0 | 0.012640 |

Step 3: Processing#

Revisiting the original model:

where:

\(FR_{i, t, \tau}\) = time \(t\) floating rate spread implied by a fixed-rate corporate bond issued by firm \(i\) at tenor \(\tau\)

We use “CS” from the original corporate bonds table for this

\(CDS_{i, t, \tau}\) = time \(t\) Credit Default Swap (CDS) par spread for firm \(i\) with tenor \(\tau\)

CDS parspread is constructed using a Cubic Spline

where:

\(y_{t, \tau}\) = duration matched treasury yield at time \(t\)

this is constructed via the “BOND_YIELD” - “CS” in the original corporate bond table

Note: Filtering

We threw out some unreasonable data for the absolute rf values exceeding 1 (risk free annual return of 100%).

processed_final_data = process_cb_spread(final_data)

processed_final_data.head()

| cusip | date | mat_days | BOND_YIELD | CS | size_ig | size_jk | par_spread | FR | CB | rfr | c_rating | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 39 | 00101JAE6 | 2014-12-31 | 927.0 | 0.033902 | 0.025627 | 1.0 | 1.0 | 0.034591 | 0.025627 | 0.008964 | -0.068971 | IG + HY |

| 45 | 00101JAE6 | 2015-03-31 | 837.0 | 0.026494 | 0.020114 | 1.0 | 1.0 | 0.017713 | 0.020114 | -0.002401 | 0.878103 | IG + HY |

| 47 | 00101JAE6 | 2015-04-30 | 807.0 | 0.024420 | 0.018444 | 1.0 | 1.0 | 0.017103 | 0.018444 | -0.001340 | 0.731656 | IG + HY |

| 51 | 00101JAE6 | 2015-06-30 | 746.0 | 0.026136 | 0.019872 | 1.0 | 1.0 | 0.016516 | 0.019872 | -0.003356 | 0.961969 | IG + HY |

| 53 | 00101JAE6 | 2015-07-31 | 715.0 | 0.022742 | 0.015899 | 1.0 | 1.0 | 0.012640 | 0.015899 | -0.003259 | 1.010164 | IG + HY |

processed_final_data.info()

<class 'pandas.core.frame.DataFrame'>

Index: 585507 entries, 39 to 1398297

Data columns (total 12 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 cusip 585507 non-null object

1 date 585507 non-null datetime64[ns]

2 mat_days 585507 non-null float64

3 BOND_YIELD 585507 non-null float64

4 CS 585507 non-null float64

5 size_ig 585507 non-null float64

6 size_jk 585507 non-null float64

7 par_spread 585507 non-null float64

8 FR 585507 non-null float64

9 CB 585507 non-null float64

10 rfr 585507 non-null float64

11 c_rating 585507 non-null object

dtypes: datetime64[ns](1), float64(9), object(2)

memory usage: 58.1+ MB

processed_final_data.describe()

| date | mat_days | BOND_YIELD | CS | size_ig | size_jk | par_spread | FR | CB | rfr | |

|---|---|---|---|---|---|---|---|---|---|---|

| count | 585507 | 585507.000000 | 585507.000000 | 585507.000000 | 585507.000000 | 585507.000000 | 585507.000000 | 585507.000000 | 585507.000000 | 585507.000000 |

| mean | 2013-08-09 15:05:17.429509632 | 3639.666931 | 0.045777 | 0.023430 | 0.849758 | 0.981083 | 0.023292 | 0.023430 | -0.000138 | 2.248486 |

| min | 2002-09-30 00:00:00 | 361.000000 | -0.791898 | -0.842717 | 0.000000 | 0.000000 | -0.964251 | -0.842717 | -0.981998 | -99.986240 |

| 25% | 2008-10-31 00:00:00 | 1320.000000 | 0.027924 | 0.009315 | 1.000000 | 1.000000 | 0.002744 | 0.009315 | -0.012180 | 1.343552 |

| 50% | 2013-12-31 00:00:00 | 2419.000000 | 0.041776 | 0.015993 | 1.000000 | 1.000000 | 0.007503 | 0.015993 | -0.005046 | 2.579079 |

| 75% | 2018-05-31 00:00:00 | 5281.000000 | 0.056008 | 0.026505 | 1.000000 | 1.000000 | 0.020888 | 0.026505 | -0.001138 | 4.404756 |

| max | 2022-09-30 00:00:00 | 36478.000000 | 5.665780 | 5.663980 | 1.000000 | 1.000000 | 5.728639 | 5.663980 | 1.043381 | 99.845030 |

| std | NaN | 3182.769546 | 0.041844 | 0.040593 | 0.357309 | 0.136232 | 0.111905 | 0.040593 | 0.104321 | 10.388473 |

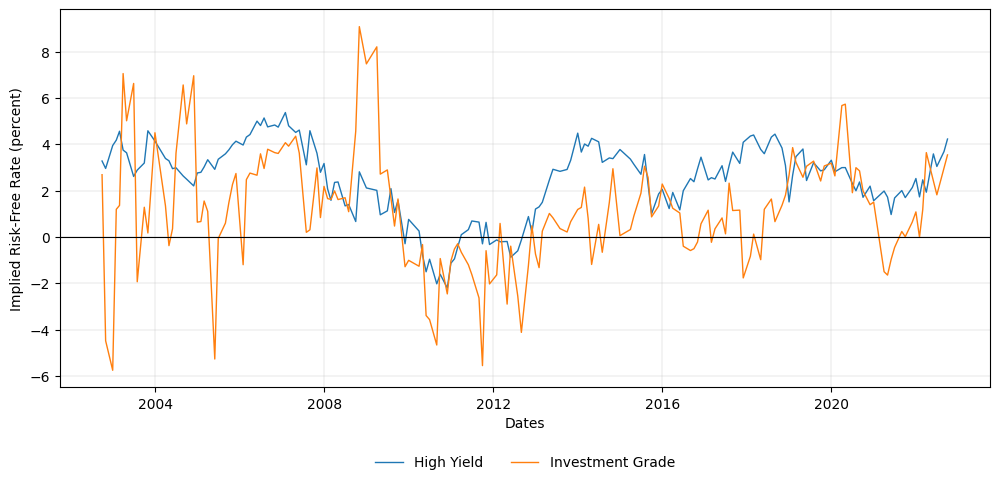

Step 4: Results#

Below is a graph of 3 categories of bonds where certain ETFs may include both IG and Junk (HY) bonds.

Rating 0: Only junk bonds (HY)

Rating 1: Only IG bonds

Rating 2: Both IG and Junk bonds (HY) in the product

generate_graph(processed_final_data)