Cleaning Summary: Covered Interest Parity (CIP) Arbitrage Spreads#

Source: Du, W., & Schreger, J. (2023). Covered Interest Parity Deviations: Macro Risks and Market Frictions. Harvard Business School. Link to paper

Data Collection and Processing Pipeline#

This analysis examines Covered Interest Parity (CIP) deviations using a two-stage data processing pipeline:

Data Retrieval (

pull_bbg_foreign_exchange.py): Fetches raw foreign exchange data from Bloomberg Terminal, including spot exchange rates, 3-month forward points, and Overnight Index Swap (OIS) rates for eight G10 currencies versus USD.CIP Calculation (

calc_cip.py): Processes the raw data to compute CIP arbitrage spreads, applying standardized transformations and outlier detection methods.

import sys

from pathlib import Path

sys.path.insert(0, "../../src")

sys.path.insert(0, "./src")

import calc_cip

import cip_analysis

import pandas as pd

from settings import config

DATA_DIR = Path(config("DATA_DIR")) / "cip"

Data Sources and Coverage#

Our analysis examines Covered Interest Parity (CIP) deviations across eight G10 currencies against the USD, using data from 1999 onwards sourced through Bloomberg Terminal. The dataset includes:

Spot exchange rates: Current market rates for currency pairs

3-month forward points: Market-quoted forward premiums/discounts

Overnight Index Swap (OIS) rates: Risk-free benchmark rates for each currency

Currency Coverage: AUD, CAD, CHF, EUR, GBP, JPY, NZD, and SEK versus USD

Data Standardization: The analysis accounts for different market quotation conventions:

Forward points are scaled appropriately (per 10,000 for most currencies, per 100 for JPY)

Currencies conventionally quoted as USD-per-foreign-currency (EUR, GBP, AUD, NZD) are converted to reciprocal rates for consistency

OIS rates serve as our risk-free benchmark to align with other arbitrage spread studies

spot_rates = pd.read_parquet(DATA_DIR / "fx_spot_rates.parquet")

fwd_pts = pd.read_parquet(DATA_DIR / "fx_forward_points.parquet")

int_rates = pd.read_parquet(DATA_DIR / "fx_interest_rates.parquet")

cip_table = calc_cip.calculate_cip(data_dir=DATA_DIR)

cip_table.tail()

| AUD | CAD | CHF | EUR | GBP | JPY | NZD | SEK | |

|---|---|---|---|---|---|---|---|---|

| index | ||||||||

| 2025-02-24 | 0.292534 | 14.172087 | 8.982214 | NaN | 1.935113 | 22.847121 | 2.971642 | 8.420659 |

| 2025-02-25 | 0.172848 | 13.621653 | 4.624919 | NaN | 1.813109 | 20.249373 | 4.234551 | 6.477765 |

| 2025-02-26 | 1.577240 | 12.271818 | 14.994926 | NaN | 2.266906 | 28.436180 | 5.401439 | 12.681800 |

| 2025-02-27 | 1.664576 | 15.707525 | 19.578262 | NaN | 3.282794 | 32.314552 | 2.293667 | 15.033099 |

| 2025-02-28 | 1.434554 | 17.483297 | 19.764014 | NaN | 3.331081 | 33.042709 | 2.293880 | 14.332039 |

Data Processing Steps#

The raw Bloomberg data undergoes several standardization steps in pull_bbg_foreign_exchange.py:

Forward Rate Calculation: Forward points are converted to actual forward rates by:

Scaling forward points (÷10,000 for most currencies, ÷100 for JPY)

Adding scaled points to corresponding spot rates

Currency Convention Standardization: To ensure consistent USD-per-foreign-currency quotation:

EUR, GBP, AUD, and NZD rates are converted to reciprocals (1.0 / original rate)

Applied to both spot and forward rates for these currencies

Data Merging: Spot rates, forward rates, and OIS rates are merged on date indices for comprehensive analysis

CIP Spread Calculation#

Using the prepared data, we calculate CIP arbitrage spreads using the log-linearized formula.

print(f"Max CIP Deviation: {cip_table.max().idxmax()}")

Max CIP Deviation: JPY

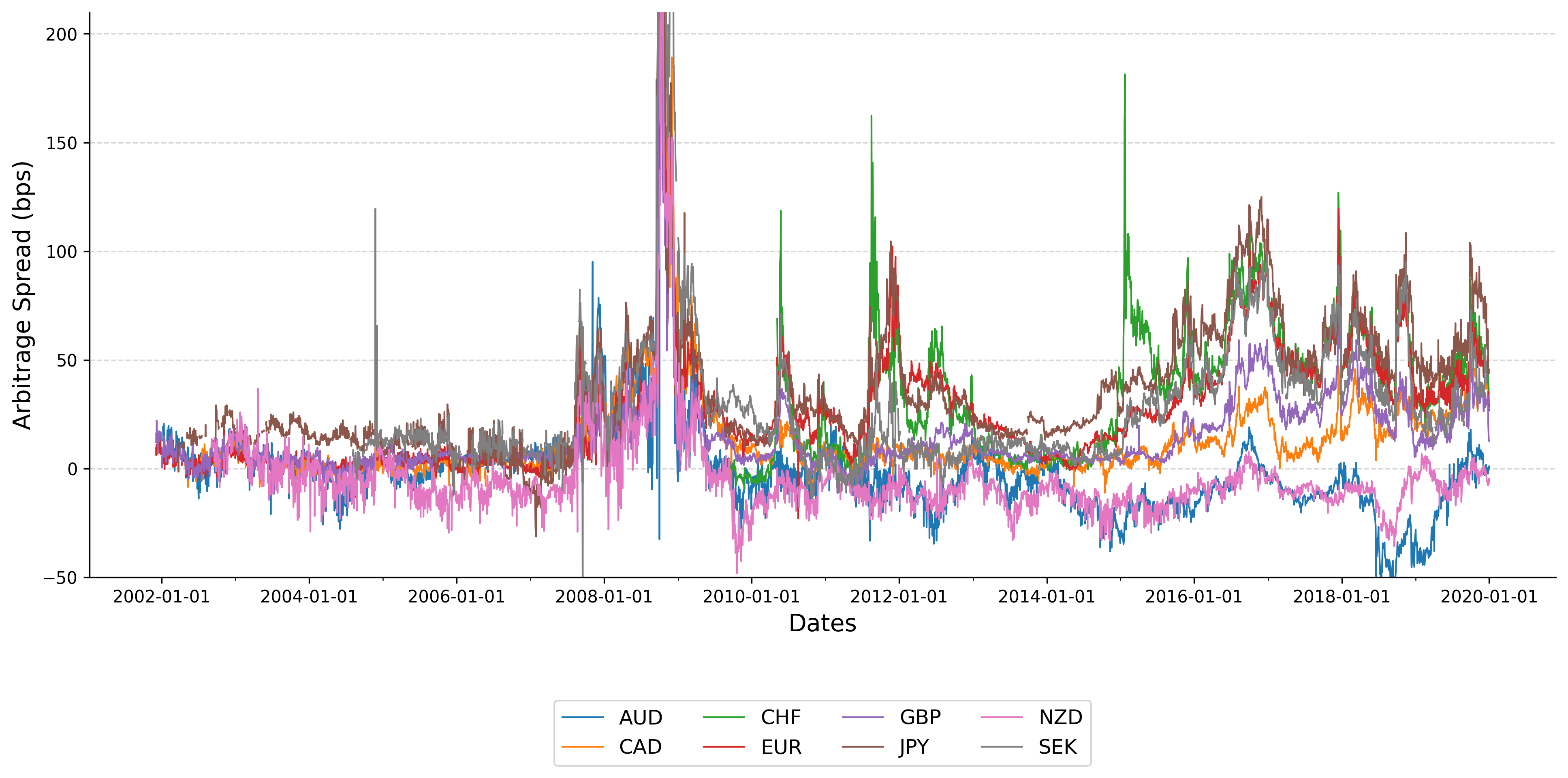

cip_table_replicate = calc_cip.calculate_cip(end_date="2020-01-01", data_dir=DATA_DIR)

cip_table_replicate.tail()

| AUD | CAD | CHF | EUR | GBP | JPY | NZD | SEK | |

|---|---|---|---|---|---|---|---|---|

| index | ||||||||

| 2019-12-26 | -2.266847 | 45.379212 | 49.482634 | NaN | 33.275712 | 63.450330 | -7.651565 | NaN |

| 2019-12-27 | -0.501872 | 42.747994 | 41.093553 | 35.335797 | 21.219397 | 44.886575 | -7.084184 | NaN |

| 2019-12-30 | -0.608663 | 36.439406 | 28.240115 | 26.613417 | 13.562790 | 43.658422 | -7.111196 | NaN |

| 2019-12-31 | 1.051805 | 29.428635 | 29.884460 | 27.209910 | 12.931200 | 45.631356 | -4.563916 | NaN |

| 2020-01-01 | 1.057455 | 29.441495 | 29.016847 | NaN | 12.657879 | 45.605954 | -5.469134 | NaN |

print(f"Max CIP Deviation: {cip_table_replicate.max().idxmax()}")

Max CIP Deviation: JPY

calc_cip.plot_cip_from_data(

cip_table_replicate, end_date="2020-01-01", output_suffix="replicate"

)

CIP Calculation and Data Cleaning Process#

The CIP spread calculation in calc_cip.py follows these steps:

CIP Formula Application:

Uses log-linearized CIP formula: CIP = 10,000 × [domestic_rate - (ln(F) - ln(S)) × (360/90) - foreign_rate]

Domestic rate: Currency-specific OIS rate

Foreign rate: USD OIS rate

Forward premium: Annualized using 360/90 day convention

Outlier Detection and Cleaning:

Implements 45-day rolling window outlier detection

Calculates rolling median and mean absolute deviation (MAD)

Removes extreme values exceeding 10× rolling MAD threshold

Replaces outliers with NaN to preserve time series structure

Output Formatting: Final spreads are expressed in basis points with shortened currency labels for analysis

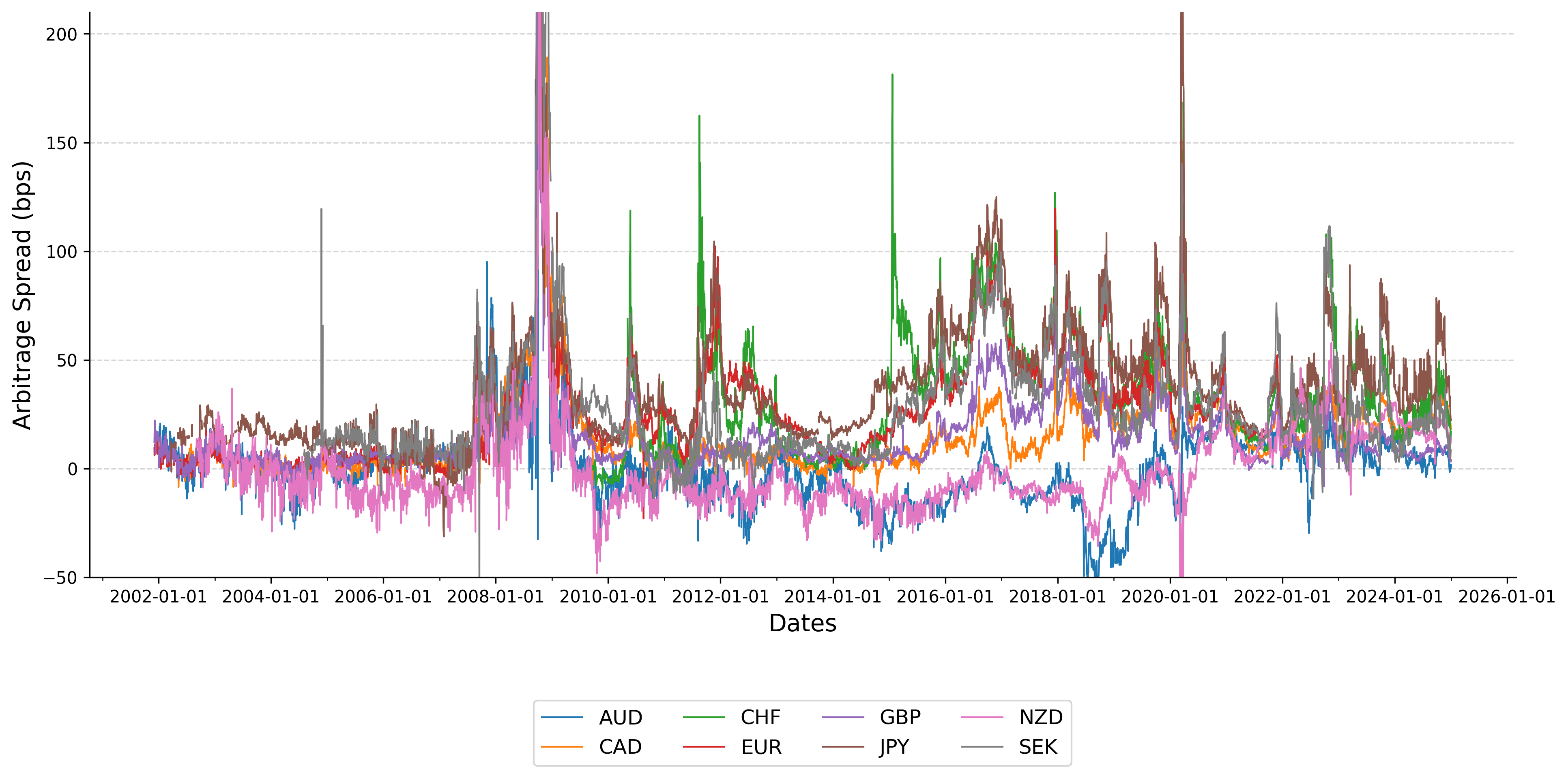

Extended Analysis: 2025 Dataset#

We extend our analysis to include more recent data through 2025 to examine contemporary CIP patterns.

cip_table_2025 = calc_cip.calculate_cip(end_date="2025-01-01", data_dir=DATA_DIR)

cip_table_2025.tail()

| AUD | CAD | CHF | EUR | GBP | JPY | NZD | SEK | |

|---|---|---|---|---|---|---|---|---|

| index | ||||||||

| 2024-12-26 | -0.766333 | 23.128393 | 24.550246 | NaN | 5.442398 | 33.221177 | 11.513906 | 15.338563 |

| 2024-12-27 | -0.479475 | 22.250737 | 19.704683 | NaN | 4.505007 | 25.733427 | 12.095516 | 3.560293 |

| 2024-12-30 | 0.007007 | 19.622446 | 12.229501 | NaN | 3.395406 | 22.690483 | 11.731758 | 8.169759 |

| 2024-12-31 | 1.955078 | 17.960460 | 16.511929 | NaN | 3.207715 | 22.661975 | 14.076388 | 8.532510 |

| 2025-01-01 | 0.911087 | 18.164521 | 16.966331 | NaN | 4.023649 | 22.194161 | 13.433583 | NaN |

calc_cip.plot_cip_from_data(cip_table_2025, end_date="2025-01-01", output_suffix="2025")

Summary Statistics and Cross-Currency Analysis#

The following section provides comprehensive statistical analysis of CIP deviations across currencies and time periods.

cip_table_2025.describe()

| AUD | CAD | CHF | EUR | GBP | JPY | NZD | SEK | |

|---|---|---|---|---|---|---|---|---|

| count | 5970.000000 | 5660.000000 | 3955.000000 | 5216.000000 | 5988.000000 | 5720.000000 | 5761.000000 | 4927.000000 |

| mean | 1.902974 | 15.416702 | 34.407832 | 26.246745 | 14.440782 | 37.639820 | 0.036919 | 29.500217 |

| std | 24.277389 | 20.871205 | 25.960965 | 28.142437 | 19.107388 | 31.686964 | 21.042555 | 32.372212 |

| min | -58.535205 | -11.137506 | -9.265949 | -22.949140 | -11.714736 | -31.232456 | -65.252431 | -75.020107 |

| 25% | -9.055422 | 3.909675 | 14.099077 | 4.896297 | 5.384825 | 17.565810 | -11.572965 | 11.210014 |

| 50% | 1.197543 | 10.259452 | 30.458430 | 21.257006 | 8.617490 | 32.102677 | -5.542426 | 22.094620 |

| 75% | 8.380603 | 21.575389 | 48.928764 | 38.609088 | 18.266183 | 49.271931 | 9.521876 | 37.419639 |

| max | 339.688767 | 313.189228 | 181.363535 | 370.943999 | 287.634939 | 439.593674 | 257.471179 | 374.543530 |

# Create a version with the column names that cip_analysis expects

cip_table_2025_for_analysis = cip_table_2025.copy()

cip_table_2025_for_analysis.columns = [

f"CIP_{col}_ln" for col in cip_table_2025_for_analysis.columns

]

stats = cip_analysis.compute_cip_statistics(cip_table_2025_for_analysis)

cip_analysis.display_cip_summary(stats)

================================================================================

OVERALL CIP STATISTICS (in basis points)

================================================================================

CIP_AUD_ln CIP_CAD_ln CIP_CHF_ln CIP_EUR_ln CIP_GBP_ln CIP_JPY_ln \

count 5970.00 5660.00 3955.00 5216.00 5988.00 5720.00

mean 1.90 15.42 34.41 26.25 14.44 37.64

std 24.28 20.87 25.96 28.14 19.11 31.69

min -58.54 -11.14 -9.27 -22.95 -11.71 -31.23

25% -9.06 3.91 14.10 4.90 5.38 17.57

50% 1.20 10.26 30.46 21.26 8.62 32.10

75% 8.38 21.58 48.93 38.61 18.27 49.27

max 339.69 313.19 181.36 370.94 287.63 439.59

CIP_NZD_ln CIP_SEK_ln

count 5761.00 4927.00

mean 0.04 29.50

std 21.04 32.37

min -65.25 -75.02

25% -11.57 11.21

50% -5.54 22.09

75% 9.52 37.42

max 257.47 374.54

cip_analysis.display_cip_corr(stats)

================================================================================

CORRELATION MATRIX

================================================================================

CIP_AUD_ln CIP_CAD_ln CIP_CHF_ln CIP_EUR_ln CIP_GBP_ln \

CIP_AUD_ln 1.000 0.714 -0.085 0.393 0.600

CIP_CAD_ln 0.714 1.000 0.505 0.760 0.830

CIP_CHF_ln -0.085 0.505 1.000 0.839 0.730

CIP_EUR_ln 0.393 0.760 0.839 1.000 0.893

CIP_GBP_ln 0.600 0.830 0.730 0.893 1.000

CIP_JPY_ln 0.405 0.767 0.827 0.939 0.849

CIP_NZD_ln 0.806 0.716 -0.003 0.446 0.529

CIP_SEK_ln 0.622 0.851 0.766 0.847 0.894

CIP_JPY_ln CIP_NZD_ln CIP_SEK_ln

CIP_AUD_ln 0.405 0.806 0.622

CIP_CAD_ln 0.767 0.716 0.851

CIP_CHF_ln 0.827 -0.003 0.766

CIP_EUR_ln 0.939 0.446 0.847

CIP_GBP_ln 0.849 0.529 0.894

CIP_JPY_ln 1.000 0.430 0.828

CIP_NZD_ln 0.430 1.000 0.598

CIP_SEK_ln 0.828 0.598 1.000

cip_analysis.display_cip_max_min(stats)

================================================================================

EXTREME CIP DEVIATIONS

================================================================================

Most Positive CIP Deviation: CIP_JPY_ln (37.64 bps)

Most Negative CIP Deviation: CIP_NZD_ln (0.04 bps)