4.5 Factor Analysis on Financial and Economic Time Series#

Factor Analysis and Principal Component Analysis on Financial and Economic Time Series

# If you're running this on Colab, make sure to install the following packages using pip.

# On you're own computer, I recommend using conda or mamba.

# !pip install pandas-datareader

# !pip install yfinance

# !conda install pandas-datareader

# !conda install yfinance

import numpy as np

import pandas as pd

from matplotlib import pyplot as plt

import yfinance as yf

import pandas_datareader as pdr

import sklearn.decomposition

import statsmodels.multivariate.pca

import config

DATA_DIR = config.DATA_DIR

Downloading macroeconomic and financial data from FRED#

fred_series_long_names = {

'BAMLH0A0HYM2': 'ICE BofA US High Yield Index Option-Adjusted Spread',

'NASDAQCOM': 'NASDAQ Composite Index',

'RIFSPPFAAD90NB': '90-Day AA Financial Commercial Paper Interest Rate',

'TB3MS': '3-Month Treasury Bill Secondary Market Rate',

'DGS10': 'Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity',

'VIXCLS': 'CBOE Volatility Index: VIX',

}

fred_series_short_names = {

'BAMLH0A0HYM2': 'High Yield Index OAS',

'NASDAQCOM': 'NASDAQ',

'RIFSPPFAAD90NB': '90-Day AA Fin CP',

'TB3MS': '3-Month T-Bill',

'DGS10': '10-Year Treasury',

'VIXCLS': 'VIX',

}

start_date = pd.to_datetime('1980-01-01')

end_date = pd.to_datetime('today')

df = pdr.get_data_fred(fred_series_short_names.keys(), start=start_date, end=end_date)

First, an aside about reading and writing data to disk.

df.to_csv(DATA_DIR / 'fred_panel.csv')

dff = pd.read_csv(DATA_DIR / 'fred_panel.csv')

dff.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 12155 entries, 0 to 12154

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 DATE 12155 non-null object

1 BAMLH0A0HYM2 7472 non-null float64

2 NASDAQCOM 11500 non-null float64

3 RIFSPPFAAD90NB 6606 non-null float64

4 TB3MS 547 non-null float64

5 DGS10 11405 non-null float64

6 VIXCLS 8994 non-null float64

dtypes: float64(6), object(1)

memory usage: 664.9+ KB

dff = pd.read_csv(DATA_DIR / 'fred_panel.csv', parse_dates=['DATE'])

dff.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 12155 entries, 0 to 12154

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 DATE 12155 non-null datetime64[ns]

1 BAMLH0A0HYM2 7472 non-null float64

2 NASDAQCOM 11500 non-null float64

3 RIFSPPFAAD90NB 6606 non-null float64

4 TB3MS 547 non-null float64

5 DGS10 11405 non-null float64

6 VIXCLS 8994 non-null float64

dtypes: datetime64[ns](1), float64(6)

memory usage: 664.9 KB

dff = dff.set_index('DATE')

df.to_parquet(DATA_DIR / 'fred_panel.parquet')

df = pd.read_parquet(DATA_DIR / 'fred_panel.parquet')

df.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 12155 entries, 1980-01-01 to 2025-08-14

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 BAMLH0A0HYM2 7472 non-null float64

1 NASDAQCOM 11500 non-null float64

2 RIFSPPFAAD90NB 6606 non-null float64

3 TB3MS 547 non-null float64

4 DGS10 11405 non-null float64

5 VIXCLS 8994 non-null float64

dtypes: float64(6)

memory usage: 664.7 KB

df

| BAMLH0A0HYM2 | NASDAQCOM | RIFSPPFAAD90NB | TB3MS | DGS10 | VIXCLS | |

|---|---|---|---|---|---|---|

| DATE | ||||||

| 1980-01-01 | NaN | NaN | NaN | 12.0 | NaN | NaN |

| 1980-01-02 | NaN | 148.17 | NaN | NaN | 10.50 | NaN |

| 1980-01-03 | NaN | 145.97 | NaN | NaN | 10.60 | NaN |

| 1980-01-04 | NaN | 148.02 | NaN | NaN | 10.66 | NaN |

| 1980-01-07 | NaN | 148.62 | NaN | NaN | 10.63 | NaN |

| ... | ... | ... | ... | ... | ... | ... |

| 2025-08-08 | 2.94 | 21450.02 | 4.21 | NaN | 4.27 | 15.15 |

| 2025-08-11 | 2.94 | 21385.40 | 4.23 | NaN | 4.27 | 16.25 |

| 2025-08-12 | 2.93 | 21681.90 | 4.20 | NaN | 4.29 | 14.73 |

| 2025-08-13 | 2.90 | 21713.14 | 4.18 | NaN | 4.24 | 14.49 |

| 2025-08-14 | 2.89 | 21710.67 | 4.22 | NaN | NaN | 14.83 |

12155 rows × 6 columns

Cleaning Data#

df = dff.rename(columns=fred_series_short_names)

df

| High Yield Index OAS | NASDAQ | 90-Day AA Fin CP | 3-Month T-Bill | 10-Year Treasury | VIX | |

|---|---|---|---|---|---|---|

| DATE | ||||||

| 1980-01-01 | NaN | NaN | NaN | 12.0 | NaN | NaN |

| 1980-01-02 | NaN | 148.17 | NaN | NaN | 10.50 | NaN |

| 1980-01-03 | NaN | 145.97 | NaN | NaN | 10.60 | NaN |

| 1980-01-04 | NaN | 148.02 | NaN | NaN | 10.66 | NaN |

| 1980-01-07 | NaN | 148.62 | NaN | NaN | 10.63 | NaN |

| ... | ... | ... | ... | ... | ... | ... |

| 2025-08-08 | 2.94 | 21450.02 | 4.21 | NaN | 4.27 | 15.15 |

| 2025-08-11 | 2.94 | 21385.40 | 4.23 | NaN | 4.27 | 16.25 |

| 2025-08-12 | 2.93 | 21681.90 | 4.20 | NaN | 4.29 | 14.73 |

| 2025-08-13 | 2.90 | 21713.14 | 4.18 | NaN | 4.24 | 14.49 |

| 2025-08-14 | 2.89 | 21710.67 | 4.22 | NaN | NaN | 14.83 |

12155 rows × 6 columns

Balanced panel? Mixed frequencies?

df['3-Month T-Bill'].dropna()

DATE

1980-01-01 12.00

1980-02-01 12.86

1980-03-01 15.20

1980-04-01 13.20

1980-05-01 8.58

...

2025-03-01 4.20

2025-04-01 4.21

2025-05-01 4.25

2025-06-01 4.23

2025-07-01 4.25

Name: 3-Month T-Bill, Length: 547, dtype: float64

Find a daily version of this series. See here: https://fred.stlouisfed.org/categories/22

We will end up using this series: https://fred.stlouisfed.org/series/DTB3

fred_series_short_names = {

'BAMLH0A0HYM2': 'High Yield Index OAS',

'NASDAQCOM': 'NASDAQ',

'RIFSPPFAAD90NB': '90-Day AA Fin CP',

'DTB3': '3-Month T-Bill',

'DGS10': '10-Year Treasury',

'VIXCLS': 'VIX',

}

df = pdr.get_data_fred(fred_series_short_names.keys(), start=start_date, end=end_date)

df = df.rename(columns=fred_series_short_names)

df

| High Yield Index OAS | NASDAQ | 90-Day AA Fin CP | 3-Month T-Bill | 10-Year Treasury | VIX | |

|---|---|---|---|---|---|---|

| DATE | ||||||

| 1980-01-01 | NaN | NaN | NaN | NaN | NaN | NaN |

| 1980-01-02 | NaN | 148.17 | NaN | 12.17 | 10.50 | NaN |

| 1980-01-03 | NaN | 145.97 | NaN | 12.10 | 10.60 | NaN |

| 1980-01-04 | NaN | 148.02 | NaN | 12.10 | 10.66 | NaN |

| 1980-01-07 | NaN | 148.62 | NaN | 11.86 | 10.63 | NaN |

| ... | ... | ... | ... | ... | ... | ... |

| 2025-08-08 | 2.94 | 21450.02 | 4.21 | 4.14 | 4.27 | 15.15 |

| 2025-08-11 | 2.94 | 21385.40 | 4.23 | 4.15 | 4.27 | 16.25 |

| 2025-08-12 | 2.93 | 21681.90 | 4.20 | 4.14 | 4.29 | 14.73 |

| 2025-08-13 | 2.90 | 21713.14 | 4.18 | 4.11 | 4.24 | 14.49 |

| 2025-08-14 | 2.89 | 21710.67 | 4.22 | NaN | NaN | 14.83 |

11999 rows × 6 columns

df.dropna()

| High Yield Index OAS | NASDAQ | 90-Day AA Fin CP | 3-Month T-Bill | 10-Year Treasury | VIX | |

|---|---|---|---|---|---|---|

| DATE | ||||||

| 1997-01-02 | 3.06 | 1280.70 | 5.35 | 5.05 | 6.54 | 21.14 |

| 1997-01-03 | 3.09 | 1310.68 | 5.35 | 5.04 | 6.52 | 19.13 |

| 1997-01-06 | 3.10 | 1316.40 | 5.34 | 5.05 | 6.54 | 19.89 |

| 1997-01-07 | 3.10 | 1327.73 | 5.33 | 5.02 | 6.57 | 19.35 |

| 1997-01-08 | 3.07 | 1320.35 | 5.31 | 5.02 | 6.60 | 20.24 |

| ... | ... | ... | ... | ... | ... | ... |

| 2025-08-07 | 2.95 | 21242.70 | 4.24 | 4.14 | 4.23 | 16.57 |

| 2025-08-08 | 2.94 | 21450.02 | 4.21 | 4.14 | 4.27 | 15.15 |

| 2025-08-11 | 2.94 | 21385.40 | 4.23 | 4.15 | 4.27 | 16.25 |

| 2025-08-12 | 2.93 | 21681.90 | 4.20 | 4.14 | 4.29 | 14.73 |

| 2025-08-13 | 2.90 | 21713.14 | 4.18 | 4.11 | 4.24 | 14.49 |

6585 rows × 6 columns

Transforming and Normalizing the data#

What is transformation and normalization? Are these different things?

Why would one transform data? What is feature engineering?

What is normalization?

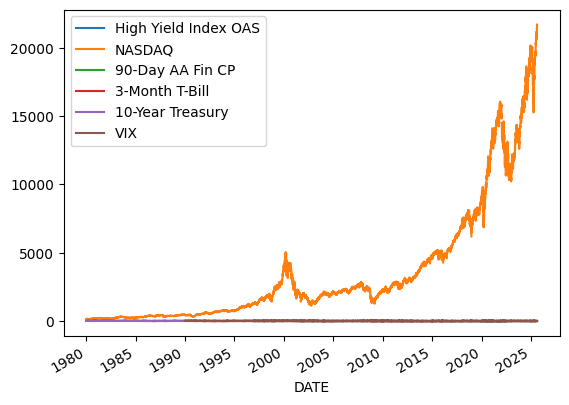

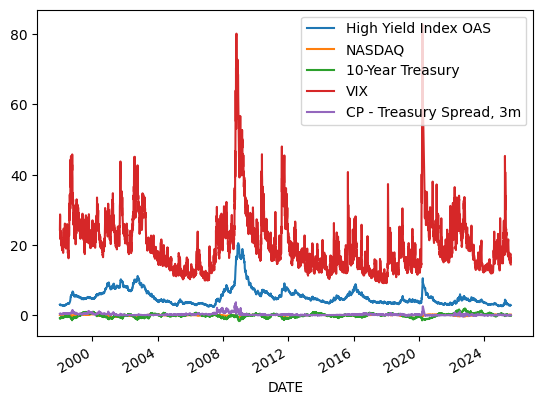

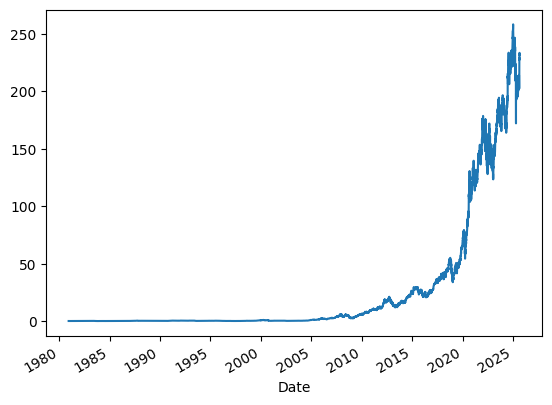

What does stationarity mean? See the the following plots. Some of these variable are stationary. Other are not? Why is this a problem?

df.plot()

<Axes: xlabel='DATE'>

df.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 11999 entries, 1980-01-01 to 2025-08-14

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 High Yield Index OAS 7472 non-null float64

1 NASDAQ 11500 non-null float64

2 90-Day AA Fin CP 6606 non-null float64

3 3-Month T-Bill 11405 non-null float64

4 10-Year Treasury 11405 non-null float64

5 VIX 8994 non-null float64

dtypes: float64(6)

memory usage: 656.2 KB

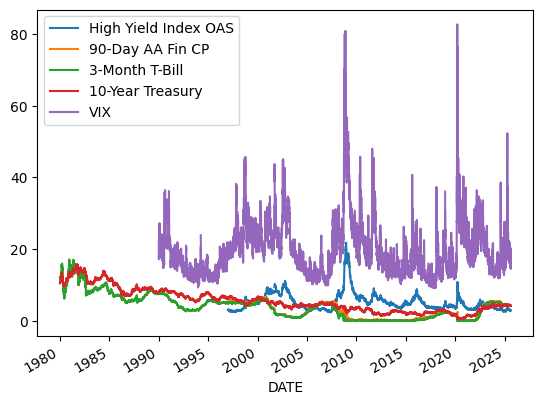

df.drop(columns=['NASDAQ']).plot()

<Axes: xlabel='DATE'>

Let’s try some transformations like those used in the OFR Financial Stress Index: https://www.financialresearch.gov/financial-stress-index/files/indicators/index.html

dfn = pd.DataFrame().reindex_like(df)

dfn

| High Yield Index OAS | NASDAQ | 90-Day AA Fin CP | 3-Month T-Bill | 10-Year Treasury | VIX | |

|---|---|---|---|---|---|---|

| DATE | ||||||

| 1980-01-01 | NaN | NaN | NaN | NaN | NaN | NaN |

| 1980-01-02 | NaN | NaN | NaN | NaN | NaN | NaN |

| 1980-01-03 | NaN | NaN | NaN | NaN | NaN | NaN |

| 1980-01-04 | NaN | NaN | NaN | NaN | NaN | NaN |

| 1980-01-07 | NaN | NaN | NaN | NaN | NaN | NaN |

| ... | ... | ... | ... | ... | ... | ... |

| 2025-08-08 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2025-08-11 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2025-08-12 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2025-08-13 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2025-08-14 | NaN | NaN | NaN | NaN | NaN | NaN |

11999 rows × 6 columns

df['NASDAQ'].rolling(250).mean()

DATE

1980-01-01 NaN

1980-01-02 NaN

1980-01-03 NaN

1980-01-04 NaN

1980-01-07 NaN

..

2025-08-08 NaN

2025-08-11 NaN

2025-08-12 NaN

2025-08-13 NaN

2025-08-14 NaN

Name: NASDAQ, Length: 11999, dtype: float64

df = df.dropna()

df['NASDAQ'].rolling(250).mean()

DATE

1997-01-02 NaN

1997-01-03 NaN

1997-01-06 NaN

1997-01-07 NaN

1997-01-08 NaN

...

2025-08-07 17255.97032

2025-08-08 17287.24620

2025-08-11 17318.88928

2025-08-12 17352.34916

2025-08-13 17386.03860

Name: NASDAQ, Length: 6585, dtype: float64

# 'High Yield Index OAS': Leave as is

dfn['High Yield Index OAS'] = df['High Yield Index OAS']

dfn['CP - Treasury Spread, 3m'] = df['90-Day AA Fin CP'] - df['3-Month T-Bill']

# 'NASDAQ': # We're using something different, but still apply rolling mean transformation

dfn['NASDAQ'] = np.log(df['NASDAQ']) - np.log(df['NASDAQ'].rolling(250).mean())

dfn['10-Year Treasury'] = df['10-Year Treasury'] - df['10-Year Treasury'].rolling(250).mean()

# 'VIX': Leave as is

dfn['VIX'] = df['VIX']

dfn = dfn.drop(columns=['90-Day AA Fin CP', '3-Month T-Bill'])

dfn = dfn.dropna()

dfn.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 6336 entries, 1998-01-05 to 2025-08-13

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 High Yield Index OAS 6336 non-null float64

1 NASDAQ 6336 non-null float64

2 10-Year Treasury 6336 non-null float64

3 VIX 6336 non-null float64

4 CP - Treasury Spread, 3m 6336 non-null float64

dtypes: float64(5)

memory usage: 297.0 KB

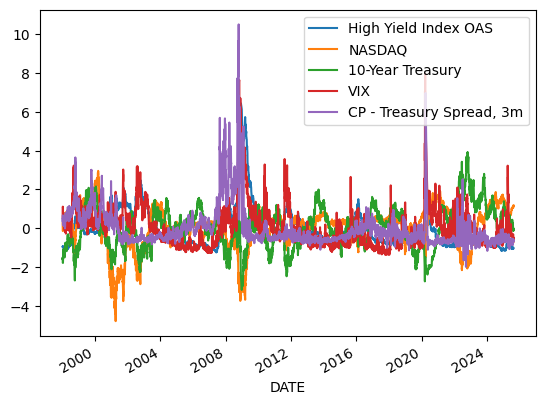

We finished with our transformations. Now, let’s normalize. First, why is it important?

dfn.plot()

<Axes: xlabel='DATE'>

Now, normalize each column, $\( z = \frac{x - \bar x}{\text{std}(x)} \)$

dfn = (dfn - dfn.mean()) / dfn.std()

dfn.plot()

<Axes: xlabel='DATE'>

def pca(dfn, module='scikitlearn'):

if module == 'statsmodels':

_pc1, _loadings, projection, rsquare, _, _, _ = statsmodels.multivariate.pca.pca(dfn,

ncomp=1, standardize=True, demean=True, normalize=True, gls=False,

weights=None, method='svd')

_loadings = _loadings['comp_0']

loadings = np.std(_pc1) * _loadings

pc1 = _pc1 / np.std(_pc1)

pc1 = pc1.rename(columns={'comp_0':'PC1'})['PC1']

elif module == 'scikitlearn':

pca = sklearn.decomposition.PCA(n_components=1)

_pc1 = pd.Series(pca.fit_transform(dfn)[:,0], index=dfn.index, name='PC1')

_loadings = pca.components_.T * np.sqrt(pca.explained_variance_)

_loadings = pd.Series(_loadings[:,0], index=dfn.columns)

loadings = np.std(_pc1) * _loadings

pc1 = _pc1 / np.std(_pc1)

pc1.name = 'PC1'

else:

raise ValueError

loadings.name = "loadings"

return pc1, loadings

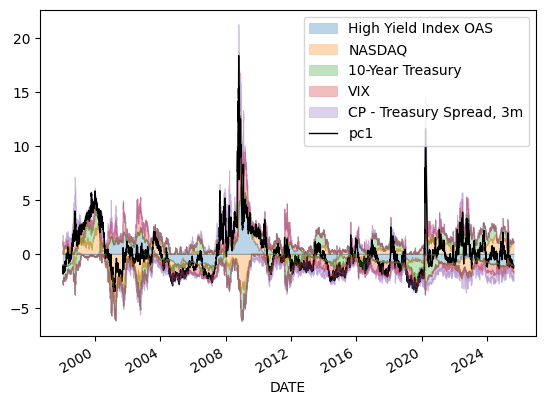

def stacked_plot(df, filename=None):

"""

df=category_contributions

# category_contributions.sum(axis=1).plot()

"""

df_pos = df[df >= 0]

df_neg = df[df < 0]

alpha = .3

linewidth = .5

ax = df_pos.plot.area(alpha=alpha, linewidth=linewidth, legend=False)

pc1 = df.sum(axis=1)

pc1.name = 'pc1'

pc1.plot(color="Black", label='pc1', linewidth=1)

plt.legend()

ax.set_prop_cycle(None)

df_neg.plot.area(alpha=alpha, ax=ax, linewidth=linewidth, legend=False, ylim=(-3,3))

# recompute the ax.dataLim

ax.relim()

# update ax.viewLim using the new dataLim

ax.autoscale()

# ax.set_ylabel('Standard Deviations')

# ax.set_ylim(-3,4)

# ax.set_ylim(-30,30)

if not (filename is None):

filename = Path(filename)

figure = plt.gcf() # get current figure

figure.set_size_inches(8, 6)

plt.savefig(filename, dpi=300)

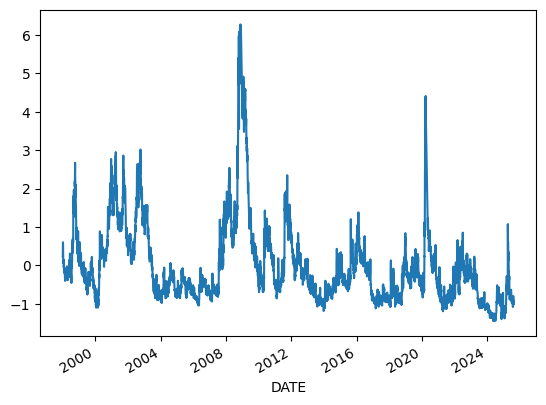

pc1, loadings = pca(dfn, module='scikitlearn')

pc1.plot()

<Axes: xlabel='DATE'>

stacked_plot(dfn)

Let’s compare solutions from two different packages

def root_mean_squared_error(sa, sb):

return np.sqrt(np.mean((sa - sb)**2))

pc1_sk, loadings_sk = pca(dfn, module='scikitlearn')

pc1_sm, loadings_sm = pca(dfn, module='statsmodels')

root_mean_squared_error(pc1_sm, pc1_sk)

/opt/homebrew/Caskroom/mambaforge/base/envs/finm/lib/python3.13/site-packages/numpy/_core/fromnumeric.py:4062: FutureWarning: The behavior of DataFrame.std with axis=None is deprecated, in a future version this will reduce over both axes and return a scalar. To retain the old behavior, pass axis=0 (or do not pass axis)

return std(axis=axis, dtype=dtype, out=out, ddof=ddof, **kwargs)

np.float64(4.679411434922667e-16)

Factor Analysis of a Panel of Stock Returns?#

# Download sample data for multiple tickers

# Note: yfinance may return different structures depending on version and number of tickers

sample = yf.download("SPY AAPL MSFT", start="2017-01-01", end="2017-04-30", progress=False)

/var/folders/l3/tj6vb0ld2ys1h939jz0qrfrh0000gn/T/ipykernel_5885/673421897.py:3: FutureWarning: YF.download() has changed argument auto_adjust default to True

sample = yf.download("SPY AAPL MSFT", start="2017-01-01", end="2017-04-30", progress=False)

# Let's examine the structure of the downloaded data

print("Sample columns:", sample.columns.tolist() if hasattr(sample, 'columns') else 'No columns attribute')

print("Sample shape:", sample.shape if hasattr(sample, 'shape') else 'No shape attribute')

if hasattr(sample, 'columns') and isinstance(sample.columns, pd.MultiIndex):

print("Column levels:", sample.columns.levels)

print("First level values:", sample.columns.levels[0].tolist())

Sample columns: [('Close', 'AAPL'), ('Close', 'MSFT'), ('Close', 'SPY'), ('High', 'AAPL'), ('High', 'MSFT'), ('High', 'SPY'), ('Low', 'AAPL'), ('Low', 'MSFT'), ('Low', 'SPY'), ('Open', 'AAPL'), ('Open', 'MSFT'), ('Open', 'SPY'), ('Volume', 'AAPL'), ('Volume', 'MSFT'), ('Volume', 'SPY')]

Sample shape: (81, 15)

Column levels: [['Close', 'High', 'Low', 'Open', 'Volume'], ['AAPL', 'MSFT', 'SPY']]

First level values: ['Close', 'High', 'Low', 'Open', 'Volume']

sample

| Price | Close | High | Low | Open | Volume | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ticker | AAPL | MSFT | SPY | AAPL | MSFT | SPY | AAPL | MSFT | SPY | AAPL | MSFT | SPY | AAPL | MSFT | SPY |

| Date | |||||||||||||||

| 2017-01-03 | 26.796825 | 56.497421 | 196.117371 | 26.838353 | 56.732149 | 196.631083 | 26.476140 | 56.091159 | 194.933213 | 26.716078 | 56.687009 | 195.943219 | 115127600 | 20694100 | 91366500 |

| 2017-01-04 | 26.766844 | 56.244614 | 197.284134 | 26.879892 | 56.650876 | 197.432152 | 26.704553 | 56.082109 | 196.439550 | 26.727624 | 56.407118 | 196.448252 | 84472400 | 21340000 | 78744400 |

| 2017-01-05 | 26.902958 | 56.244614 | 197.127396 | 26.960635 | 56.569623 | 197.284129 | 26.718390 | 56.000856 | 196.326349 | 26.743768 | 56.145305 | 197.014213 | 88774400 | 24876000 | 78379000 |

| 2017-01-06 | 27.202881 | 56.732140 | 197.832642 | 27.260558 | 57.012010 | 198.302816 | 26.870660 | 56.009898 | 196.692008 | 26.942179 | 56.244625 | 197.240556 | 127007600 | 19922900 | 71559900 |

| 2017-01-09 | 27.452047 | 56.551567 | 197.179642 | 27.553560 | 56.948803 | 197.710772 | 27.209804 | 56.461288 | 197.144806 | 27.212110 | 56.659902 | 197.571456 | 134247600 | 20382700 | 46939700 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2017-04-24 | 33.282696 | 61.335896 | 207.403244 | 33.354525 | 61.453976 | 207.613127 | 33.176108 | 60.945336 | 205.120820 | 33.250257 | 61.290486 | 207.411984 | 68537200 | 29770000 | 119209900 |

| 2017-04-25 | 33.488934 | 61.690125 | 208.610046 | 33.574665 | 61.799120 | 208.959838 | 33.336005 | 61.399476 | 207.962918 | 33.345275 | 61.671962 | 208.050372 | 75486000 | 30242700 | 76698300 |

| 2017-04-26 | 33.291969 | 61.608391 | 208.478851 | 33.505145 | 62.044360 | 209.467031 | 33.222459 | 61.417654 | 208.435137 | 33.475022 | 61.835460 | 208.575046 | 80164800 | 26190800 | 84702500 |

| 2017-04-27 | 33.317463 | 62.008022 | 208.653793 | 33.403198 | 62.107933 | 208.959858 | 33.206243 | 61.381316 | 208.111599 | 33.347586 | 61.899034 | 208.802455 | 56985200 | 34971000 | 57410300 |

| 2017-04-28 | 33.285015 | 62.180584 | 208.199036 | 33.435628 | 62.798212 | 208.942346 | 33.196968 | 61.481214 | 208.067854 | 33.386968 | 62.589312 | 208.916112 | 83441600 | 39548800 | 63532800 |

81 rows × 15 columns

# When downloading multiple tickers, yfinance returns a DataFrame with MultiIndex columns

# The first level is the data type (e.g., 'Adj Close'), the second level is the ticker

# Display the adjusted close prices for all tickers

adj_close_data = sample['Adj Close'] if 'Adj Close' in sample.columns.get_level_values(0) else sample

adj_close_data

| Price | Close | High | Low | Open | Volume | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ticker | AAPL | MSFT | SPY | AAPL | MSFT | SPY | AAPL | MSFT | SPY | AAPL | MSFT | SPY | AAPL | MSFT | SPY |

| Date | |||||||||||||||

| 2017-01-03 | 26.796825 | 56.497421 | 196.117371 | 26.838353 | 56.732149 | 196.631083 | 26.476140 | 56.091159 | 194.933213 | 26.716078 | 56.687009 | 195.943219 | 115127600 | 20694100 | 91366500 |

| 2017-01-04 | 26.766844 | 56.244614 | 197.284134 | 26.879892 | 56.650876 | 197.432152 | 26.704553 | 56.082109 | 196.439550 | 26.727624 | 56.407118 | 196.448252 | 84472400 | 21340000 | 78744400 |

| 2017-01-05 | 26.902958 | 56.244614 | 197.127396 | 26.960635 | 56.569623 | 197.284129 | 26.718390 | 56.000856 | 196.326349 | 26.743768 | 56.145305 | 197.014213 | 88774400 | 24876000 | 78379000 |

| 2017-01-06 | 27.202881 | 56.732140 | 197.832642 | 27.260558 | 57.012010 | 198.302816 | 26.870660 | 56.009898 | 196.692008 | 26.942179 | 56.244625 | 197.240556 | 127007600 | 19922900 | 71559900 |

| 2017-01-09 | 27.452047 | 56.551567 | 197.179642 | 27.553560 | 56.948803 | 197.710772 | 27.209804 | 56.461288 | 197.144806 | 27.212110 | 56.659902 | 197.571456 | 134247600 | 20382700 | 46939700 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2017-04-24 | 33.282696 | 61.335896 | 207.403244 | 33.354525 | 61.453976 | 207.613127 | 33.176108 | 60.945336 | 205.120820 | 33.250257 | 61.290486 | 207.411984 | 68537200 | 29770000 | 119209900 |

| 2017-04-25 | 33.488934 | 61.690125 | 208.610046 | 33.574665 | 61.799120 | 208.959838 | 33.336005 | 61.399476 | 207.962918 | 33.345275 | 61.671962 | 208.050372 | 75486000 | 30242700 | 76698300 |

| 2017-04-26 | 33.291969 | 61.608391 | 208.478851 | 33.505145 | 62.044360 | 209.467031 | 33.222459 | 61.417654 | 208.435137 | 33.475022 | 61.835460 | 208.575046 | 80164800 | 26190800 | 84702500 |

| 2017-04-27 | 33.317463 | 62.008022 | 208.653793 | 33.403198 | 62.107933 | 208.959858 | 33.206243 | 61.381316 | 208.111599 | 33.347586 | 61.899034 | 208.802455 | 56985200 | 34971000 | 57410300 |

| 2017-04-28 | 33.285015 | 62.180584 | 208.199036 | 33.435628 | 62.798212 | 208.942346 | 33.196968 | 61.481214 | 208.067854 | 33.386968 | 62.589312 | 208.916112 | 83441600 | 39548800 | 63532800 |

81 rows × 15 columns

tickers = [

'AAPL','ABBV','ABT','ACN','ADP','ADSK','AES','AET','AFL','AMAT','AMGN','AMZN','APA',

'APHA','APD','APTV','ARE','ASML','ATVI','AXP','BA','BAC','BAX','BDX','BIIB','BK',

'BKNG','BMY','BRKB','BRK.A','COG','COST','CPB','CRM','CSCO','CVS','DAL','DD','DHR',

'DIS','DOW','DUK','EMR','EPD','EQT','ESRT','EXPD','FFIV','FLS','FLT','FRT','GE',

'GILD','GOOGL','GOOG','GS','HAL','HD','HON','IBM','INTC','IP','JNJ','JPM','KEY',

'KHC','KIM','KO','LLY','LMT','LOW','MCD','MCHP','MDT','MMM','MO','MRK','MSFT',

'MTD','NEE','NFLX','NKE','NOV','ORCL','OXY','PEP','PFE','PG','RTN','RTX','SBUX',

'SHW','SLB','SO','SPG','STT','T','TGT','TXN','UNH','UPS','USB','UTX','V','VZ',

'WMT','XOM',

]

all_tickers = " ".join(tickers)

all_tickers

'AAPL ABBV ABT ACN ADP ADSK AES AET AFL AMAT AMGN AMZN APA APHA APD APTV ARE ASML ATVI AXP BA BAC BAX BDX BIIB BK BKNG BMY BRKB BRK.A COG COST CPB CRM CSCO CVS DAL DD DHR DIS DOW DUK EMR EPD EQT ESRT EXPD FFIV FLS FLT FRT GE GILD GOOGL GOOG GS HAL HD HON IBM INTC IP JNJ JPM KEY KHC KIM KO LLY LMT LOW MCD MCHP MDT MMM MO MRK MSFT MTD NEE NFLX NKE NOV ORCL OXY PEP PFE PG RTN RTX SBUX SHW SLB SO SPG STT T TGT TXN UNH UPS USB UTX V VZ WMT XOM'

data = yf.download(all_tickers, start="1980-01-01", end=pd.to_datetime('today'), progress=False)

/var/folders/l3/tj6vb0ld2ys1h939jz0qrfrh0000gn/T/ipykernel_5885/3096157927.py:1: FutureWarning: YF.download() has changed argument auto_adjust default to True

data = yf.download(all_tickers, start="1980-01-01", end=pd.to_datetime('today'), progress=False)

9 Failed downloads:

['BRK.A', 'FLT', 'COG', 'APHA', 'RTN', 'UTX', 'BRKB', 'ATVI']: YFTzMissingError('possibly delisted; no timezone found')

['MRK']: Timeout('Failed to perform, curl: (28) Connection timed out after 10002 milliseconds. See https://curl.se/libcurl/c/libcurl-errors.html first for more details.')

data

| Price | Adj Close | Close | ... | Volume | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ticker | APHA | ATVI | BRK.A | BRKB | COG | FLT | MRK | RTN | UTX | AAPL | ... | TGT | TXN | UNH | UPS | USB | UTX | V | VZ | WMT | XOM |

| Date | |||||||||||||||||||||

| 1980-01-02 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | 3691200 | 3796800.0 | NaN | NaN | 21600.0 | NaN | NaN | NaN | 2073600.0 | 6622400.0 |

| 1980-01-03 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | 1468800 | 3134400.0 | NaN | NaN | 39600.0 | NaN | NaN | NaN | 4608000.0 | 7222400.0 |

| 1980-01-04 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | 3206400 | 1195200.0 | NaN | NaN | 10800.0 | NaN | NaN | NaN | 2764800.0 | 4780800.0 |

| 1980-01-07 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | 422400 | 2068800.0 | NaN | NaN | 36000.0 | NaN | NaN | NaN | 1228800.0 | 8331200.0 |

| 1980-01-08 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | 451200 | 5414400.0 | NaN | NaN | 72000.0 | NaN | NaN | NaN | 5913600.0 | 8048000.0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2025-08-11 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 227.179993 | ... | 5020200 | 6457800.0 | 11779500.0 | 8701400.0 | 7201900.0 | NaN | 5715800.0 | 12914900.0 | 12856700.0 | 13570700.0 |

| 2025-08-12 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 229.649994 | ... | 6593800 | 9961500.0 | 12171800.0 | 7308600.0 | 8836600.0 | NaN | 5682800.0 | 12469300.0 | 17915300.0 | 14109400.0 |

| 2025-08-13 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 233.330002 | ... | 7364700 | 4966300.0 | 19480300.0 | 13633200.0 | 10438100.0 | NaN | 5693400.0 | 14327700.0 | 19398500.0 | 17958700.0 |

| 2025-08-14 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 232.779999 | ... | 4985000 | 3916400.0 | 22987500.0 | 12455700.0 | 6181100.0 | NaN | 6223200.0 | 10580600.0 | 10851800.0 | 13677600.0 |

| 2025-08-15 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 231.294998 | ... | 4576323 | NaN | 61957831.0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

11500 rows × 544 columns

data['Close']['AAPL'].plot()

<Axes: xlabel='Date'>

cols_with_many_nas = [

"BRK.A",

"APHA",

"UTX",

"RTN",

"COG",

"BRKB",

"ATVI",

"FLT",

"DOW",

"KHC",

"V",

"APTV",

"ABBV",

"ESRT",

]

df = data['Close']

print(f"Initial shape: {df.shape}")

df = df.drop(columns=cols_with_many_nas, errors='ignore')

print(f"After dropping columns: {df.shape}")

df = df.dropna()

print(f"After first dropna: {df.shape}")

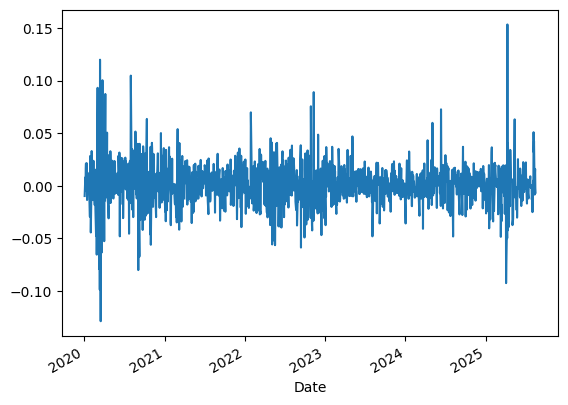

df = df.pct_change()

print(f"After pct_change: {df.shape}")

df = df.dropna()

print(f"Final shape: {df.shape}")

# If DataFrame is empty, use a smaller date range or fewer tickers

if df.empty:

print("DataFrame is empty! Trying with fewer tickers and recent data...")

simple_tickers = ['AAPL', 'MSFT', 'GOOGL', 'AMZN', 'TSLA']

data = yf.download(" ".join(simple_tickers), start="2020-01-01", end=pd.to_datetime('today'), progress=False)

df = data['Close'].pct_change().dropna()

print(f"New shape with simple tickers: {df.shape}")

Initial shape: (11500, 107)

After dropping columns: (11500, 93)

After first dropna: (0, 93)

After pct_change: (0, 93)

Final shape: (0, 93)

DataFrame is empty! Trying with fewer tickers and recent data...

/var/folders/l3/tj6vb0ld2ys1h939jz0qrfrh0000gn/T/ipykernel_5885/809774618.py:32: FutureWarning: YF.download() has changed argument auto_adjust default to True

data = yf.download(" ".join(simple_tickers), start="2020-01-01", end=pd.to_datetime('today'), progress=False)

New shape with simple tickers: (1412, 5)

df.columns

Index(['AAPL', 'AMZN', 'GOOGL', 'MSFT', 'TSLA'], dtype='object', name='Ticker')

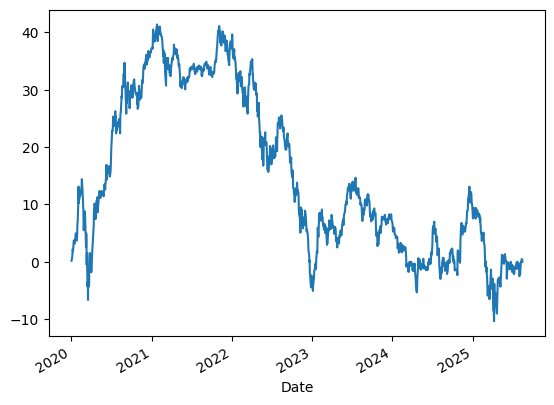

df['AAPL'].plot()

<Axes: xlabel='Date'>

if not df.empty:

pc1, loadings = pca(df, module='scikitlearn')

print(f"PCA completed successfully. PC1 shape: {pc1.shape}")

else:

print("Cannot run PCA on empty DataFrame!")

pc1 = pd.Series(dtype=float)

loadings = pd.Series(dtype=float)

PCA completed successfully. PC1 shape: (1412,)

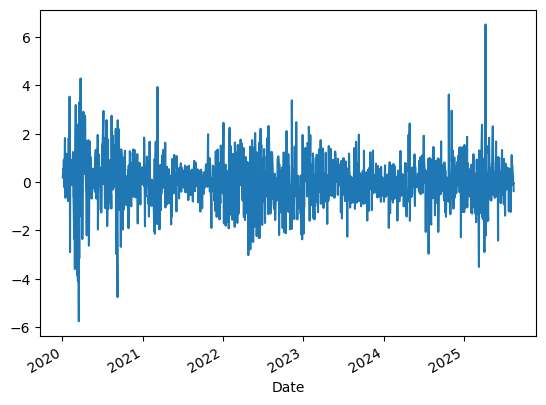

if not pc1.empty:

pc1.plot()

else:

print("No data to plot for PC1")

if not pc1.empty:

pc1.cumsum().plot()

else:

print("No data to plot for cumulative PC1")