3.3 Exploring CRSP Data with Python#

This script demonstrates how to explore and analyze CRSP daily stock data using various Python plotting libraries.

Overview#

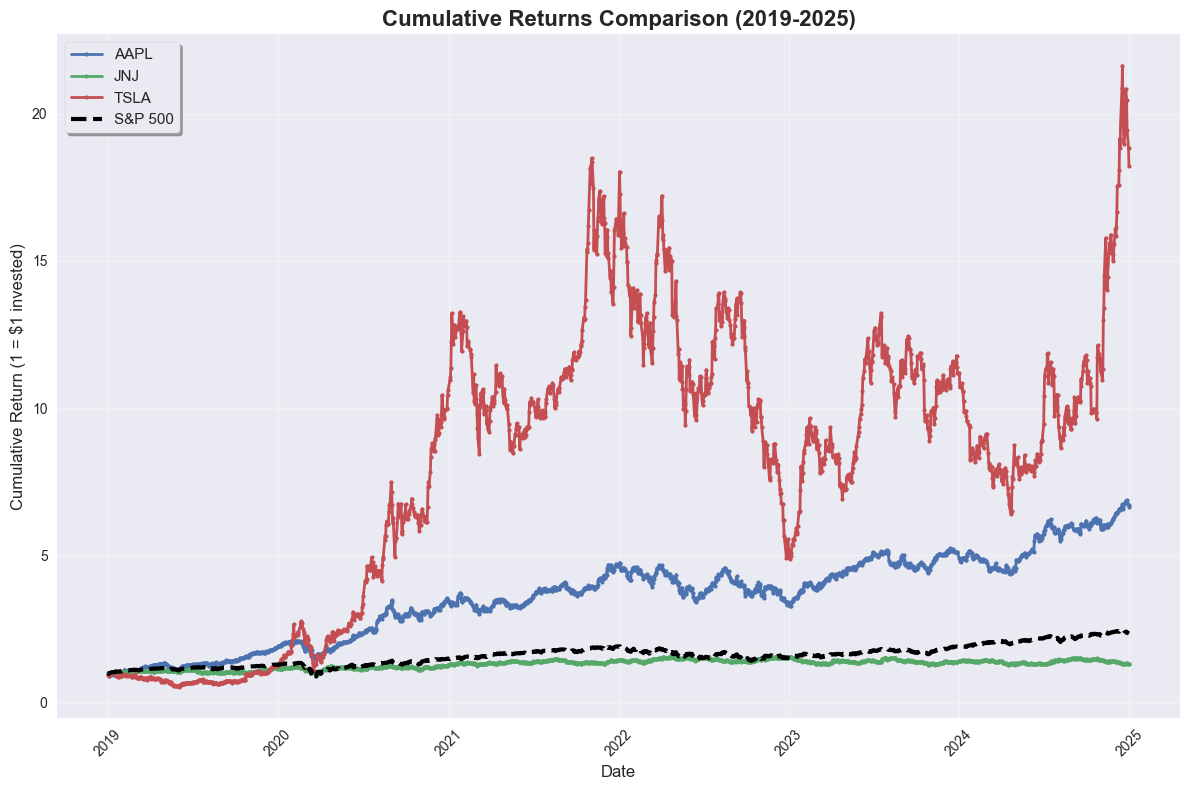

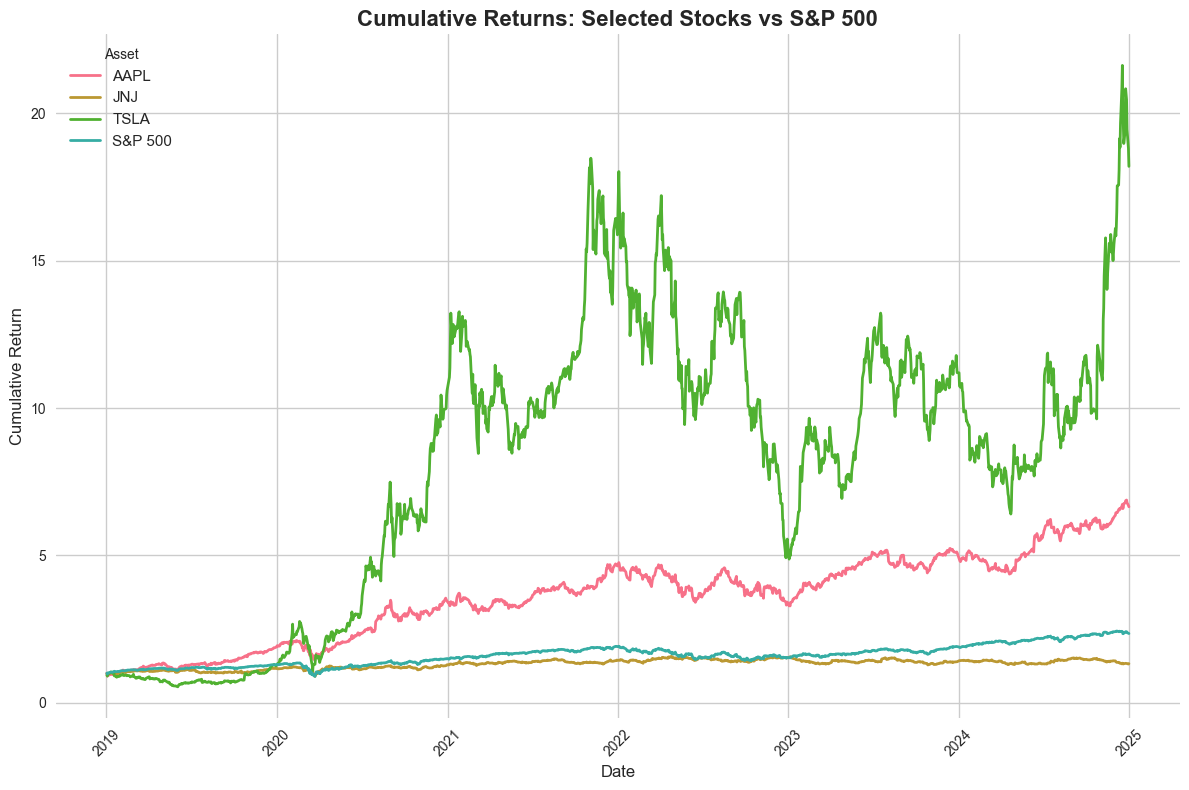

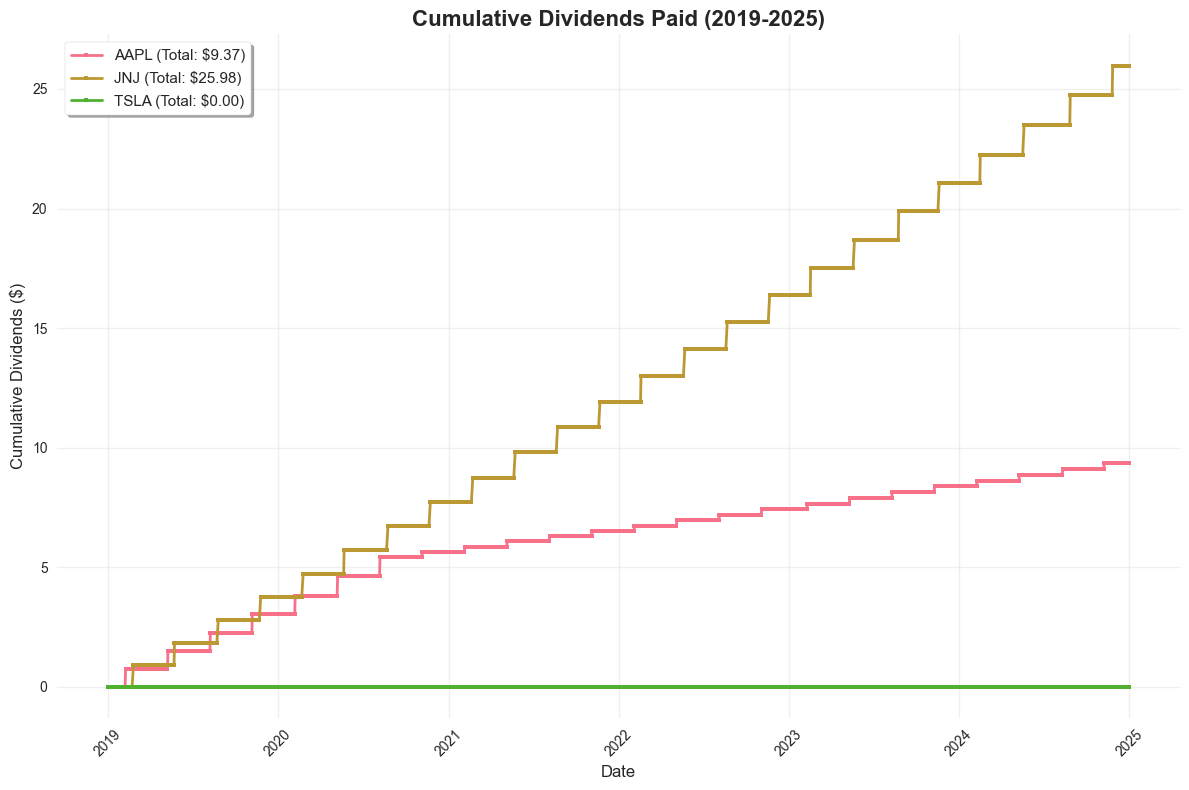

We’ll analyze CRSP daily stock data for selected stocks (AAPL, JNJ, TSLA) and compare their performance against the S&P 500 index. The analysis includes:

Cumulative returns comparison

Dividend analysis

Rolling volatility analysis

Multiple plotting approaches (Matplotlib, Seaborn, Plotly)

Data Source#

CRSP Daily Stock File v2 (DSF) via WRDS

Filtered for common stock universe with proper exchange and trading filters

Date range: 2019-2025

import pandas as pd

import numpy as np

import wrds

import matplotlib.pyplot as plt

import seaborn as sns

import plotly.express as px

import plotly.graph_objects as go

from plotly.subplots import make_subplots

from datetime import datetime, timedelta

import config

DATA_DIR = config.DATA_DIR

WRDS_USERNAME = config.WRDS_USERNAME

db = wrds.Connection(wrds_username=WRDS_USERNAME)

Loading library list...

Done

Understanding CRSP Data Structure#

To find the right table, we use a combination of the web query interface and the SAS Studio explorer. The web query interface is available at: https://wrds-www.wharton.upenn.edu/pages/get-data/center-research-security-prices-crsp/annual-update/stock-version-2/daily-stock-file/

Note: Web queries often use merges of tables from many different sources. The results of these merges are not usually available through the Python API interface. Often, you’ll have to merge the tables yourself.

However, in this case, we can use the SAS Studio explorer to find the right table. Lucky for us, the data in the web query is available in a pre-merged table available through the Python API.

# First, let's look at the standard daily stock file (DSF) from the CIZ format

dsf = db.get_table(library="crsp", table="dsf_v2", obs=10)

dsf.head()

| permno | hdrcusip | permco | siccd | nasdissuno | yyyymmdd | sharetype | securitytype | securitysubtype | usincflg | ... | dlyopen | dlynumtrd | dlymmcnt | dlyprcvol | dlycumfacpr | dlycumfacshr | cusip | ticker | exchangetier | shrout | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 10000 | 68391610 | 7952 | 3990 | 10396 | 19860107 | NS | EQTY | COM | Y | ... | <NA> | <NA> | 9 | 2562.5 | 1.0 | 1.0 | 68391610 | OMFGA | SC1 | 3680 |

| 1 | 10000 | 68391610 | 7952 | 3990 | 10396 | 19860108 | NS | EQTY | COM | Y | ... | <NA> | <NA> | 9 | 32000.0 | 1.0 | 1.0 | 68391610 | OMFGA | SC1 | 3680 |

| 2 | 10000 | 68391610 | 7952 | 3990 | 10396 | 19860109 | NS | EQTY | COM | Y | ... | <NA> | <NA> | 9 | 3500.0 | 1.0 | 1.0 | 68391610 | OMFGA | SC1 | 3680 |

| 3 | 10000 | 68391610 | 7952 | 3990 | 10396 | 19860110 | NS | EQTY | COM | Y | ... | <NA> | <NA> | 10 | 21250.0 | 1.0 | 1.0 | 68391610 | OMFGA | SC1 | 3680 |

| 4 | 10000 | 68391610 | 7952 | 3990 | 10396 | 19860113 | NS | EQTY | COM | Y | ... | <NA> | <NA> | 10 | 14306.3 | 1.0 | 1.0 | 68391610 | OMFGA | SC1 | 3680 |

5 rows × 50 columns

dsf.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 10 entries, 0 to 9

Data columns (total 50 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 permno 10 non-null Int64

1 hdrcusip 10 non-null string

2 permco 10 non-null Int64

3 siccd 10 non-null Int64

4 nasdissuno 10 non-null Int64

5 yyyymmdd 10 non-null Int64

6 sharetype 10 non-null string

7 securitytype 10 non-null string

8 securitysubtype 10 non-null string

9 usincflg 10 non-null string

10 issuertype 10 non-null string

11 primaryexch 10 non-null string

12 conditionaltype 10 non-null string

13 tradingstatusflg 10 non-null string

14 dlycaldt 10 non-null string

15 dlydelflg 10 non-null string

16 dlyprc 10 non-null Float64

17 dlyprcflg 10 non-null string

18 dlycap 10 non-null Float64

19 dlycapflg 10 non-null string

20 dlyprevprc 9 non-null Float64

21 dlyprevprcflg 10 non-null string

22 dlyprevdt 9 non-null string

23 dlyprevcap 9 non-null Float64

24 dlyprevcapflg 10 non-null string

25 dlyret 9 non-null Float64

26 dlyretx 9 non-null Float64

27 dlyreti 9 non-null Float64

28 dlyretmissflg 10 non-null string

29 dlyretdurflg 10 non-null string

30 dlyorddivamt 10 non-null Float64

31 dlynonorddivamt 10 non-null Float64

32 dlyfacprc 10 non-null Float64

33 dlydistretflg 10 non-null string

34 dlyvol 10 non-null Float64

35 dlyclose 0 non-null string

36 dlylow 0 non-null string

37 dlyhigh 0 non-null string

38 dlybid 10 non-null Float64

39 dlyask 10 non-null Float64

40 dlyopen 0 non-null string

41 dlynumtrd 0 non-null string

42 dlymmcnt 10 non-null Int64

43 dlyprcvol 10 non-null Float64

44 dlycumfacpr 10 non-null Float64

45 dlycumfacshr 10 non-null Float64

46 cusip 10 non-null string

47 ticker 10 non-null string

48 exchangetier 10 non-null string

49 shrout 10 non-null Int64

dtypes: Float64(16), Int64(7), string(27)

memory usage: 4.3 KB

Finding the Pre-merged Table#

Now, let’s find the pre-merged table that contains the data we want. Notice that it corresponds to the web query we used above.

df = db.get_table(library="crsp", table="wrds_dsfv2_query", obs=10)

df.head()

| permno | secinfostartdt | secinfoenddt | securitybegdt | securityenddt | securityhdrflg | hdrcusip | hdrcusip9 | cusip | cusip9 | ... | disrecorddt | dispaydt | dispermno | dispermco | disamountsourcetype | vwretd | vwretx | ewretd | ewretx | sprtrn | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 10000 | 1986-01-07 | 1986-12-03 | 1986-01-07 | 1987-06-11 | N | 68391610 | 683916100 | 68391610 | 683916100 | ... | <NA> | <NA> | <NA> | <NA> | <NA> | 0.013809 | 0.0138 | 0.011061 | 0.011046 | 0.014954 |

| 1 | 10000 | 1986-01-07 | 1986-12-03 | 1986-01-07 | 1987-06-11 | N | 68391610 | 683916100 | 68391610 | 683916100 | ... | <NA> | <NA> | <NA> | <NA> | <NA> | -0.020744 | -0.02075 | -0.005117 | -0.005135 | -0.027269 |

| 2 | 10000 | 1986-01-07 | 1986-12-03 | 1986-01-07 | 1987-06-11 | N | 68391610 | 683916100 | 68391610 | 683916100 | ... | <NA> | <NA> | <NA> | <NA> | <NA> | -0.011219 | -0.011315 | -0.011588 | -0.01166 | -0.008944 |

| 3 | 10000 | 1986-01-07 | 1986-12-03 | 1986-01-07 | 1987-06-11 | N | 68391610 | 683916100 | 68391610 | 683916100 | ... | <NA> | <NA> | <NA> | <NA> | <NA> | 0.000083 | 0.000047 | 0.003651 | 0.003632 | -0.000728 |

| 4 | 10000 | 1986-01-07 | 1986-12-03 | 1986-01-07 | 1987-06-11 | N | 68391610 | 683916100 | 68391610 | 683916100 | ... | <NA> | <NA> | <NA> | <NA> | <NA> | 0.00275 | 0.00268 | 0.002433 | 0.002369 | 0.00369 |

5 rows × 98 columns

Note: We actually just made a mistake above. For some reason, we aren’t allowed to access this via “crspa”, but we are via “crsp”.

df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 10 entries, 0 to 9

Data columns (total 98 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 permno 10 non-null Int64

1 secinfostartdt 10 non-null string

2 secinfoenddt 10 non-null string

3 securitybegdt 10 non-null string

4 securityenddt 10 non-null string

5 securityhdrflg 10 non-null string

6 hdrcusip 10 non-null string

7 hdrcusip9 10 non-null string

8 cusip 10 non-null string

9 cusip9 10 non-null string

10 primaryexch 10 non-null string

11 conditionaltype 10 non-null string

12 exchangetier 10 non-null string

13 tradingstatusflg 10 non-null string

14 securitynm 10 non-null string

15 shareclass 10 non-null string

16 usincflg 10 non-null string

17 issuertype 10 non-null string

18 securitytype 10 non-null string

19 securitysubtype 10 non-null string

20 sharetype 10 non-null string

21 securityactiveflg 10 non-null string

22 delactiontype 10 non-null string

23 delstatustype 10 non-null string

24 delreasontype 10 non-null string

25 delpaymenttype 10 non-null string

26 ticker 10 non-null string

27 tradingsymbol 10 non-null string

28 permco 10 non-null Int64

29 siccd 10 non-null Int64

30 naics 10 non-null string

31 icbindustry 10 non-null string

32 uesindustry 10 non-null string

33 nasdcompno 10 non-null Int64

34 nasdissuno 10 non-null Int64

35 issuernm 10 non-null string

36 yyyymmdd 10 non-null Int64

37 dlycaldt 10 non-null string

38 dlydelflg 10 non-null string

39 dlyprc 10 non-null Float64

40 dlyprcflg 10 non-null string

41 dlycap 10 non-null Float64

42 dlycapflg 10 non-null string

43 dlyprevprc 9 non-null Float64

44 dlyprevprcflg 10 non-null string

45 dlyprevdt 9 non-null string

46 dlyprevcap 9 non-null Float64

47 dlyprevcapflg 10 non-null string

48 dlyret 9 non-null Float64

49 dlyretx 9 non-null Float64

50 dlyreti 9 non-null Float64

51 dlyretmissflg 10 non-null string

52 dlyretdurflg 10 non-null string

53 dlyorddivamt 10 non-null Float64

54 dlynonorddivamt 10 non-null Float64

55 dlyfacprc 10 non-null Float64

56 dlydistretflg 10 non-null string

57 dlyvol 10 non-null Float64

58 dlyclose 0 non-null string

59 dlylow 0 non-null string

60 dlyhigh 0 non-null string

61 dlybid 10 non-null Float64

62 dlyask 10 non-null Float64

63 dlyopen 0 non-null string

64 dlynumtrd 0 non-null string

65 dlymmcnt 10 non-null Int64

66 dlyprcvol 10 non-null Float64

67 shrstartdt 10 non-null string

68 shrenddt 10 non-null string

69 shrout 10 non-null Int64

70 shrsource 10 non-null string

71 shrfactype 10 non-null string

72 shradrflg 10 non-null string

73 dlycumfacpr 10 non-null Float64

74 dlycumfacshr 10 non-null Float64

75 disexdt 0 non-null string

76 disseqnbr 0 non-null string

77 disordinaryflg 0 non-null string

78 distype 0 non-null string

79 disfreqtype 0 non-null string

80 dispaymenttype 0 non-null string

81 disdetailtype 0 non-null string

82 distaxtype 0 non-null string

83 disorigcurtype 0 non-null string

84 disdivamt 0 non-null string

85 disfacpr 0 non-null string

86 disfacshr 0 non-null string

87 disdeclaredt 0 non-null string

88 disrecorddt 0 non-null string

89 dispaydt 0 non-null string

90 dispermno 0 non-null string

91 dispermco 0 non-null string

92 disamountsourcetype 0 non-null string

93 vwretd 10 non-null Float64

94 vwretx 10 non-null Float64

95 ewretd 10 non-null Float64

96 ewretx 10 non-null Float64

97 sprtrn 10 non-null Float64

dtypes: Float64(21), Int64(8), string(69)

memory usage: 8.1 KB

Notice that this now matches the web query variables list.

Defining the Data Query#

Now, let’s explore some of the columns. But first, we need to download more data.

query = """

SELECT

permno,

permco,

dlycaldt,

issuertype,

securitytype,

securitysubtype,

sharetype,

usincflg,

primaryexch,

conditionaltype,

tradingstatusflg,

dlyret,

dlyretx,

dlyreti,

dlyorddivamt,

dlynonorddivamt,

shrout,

dlyprc,

ticker,

securitynm,

sprtrn,

vwretd

FROM

crsp.wrds_dsfv2_query

WHERE

dlycaldt between '01/01/2019' and '01/01/2025' AND

sharetype = 'NS' AND

securitytype = 'EQTY' AND

securitysubtype = 'COM' AND

usincflg = 'Y' AND

issuertype IN ('ACOR', 'CORP') AND

primaryexch IN ('N', 'A', 'Q') AND

conditionaltype = 'RW' AND

tradingstatusflg = 'A'

"""

def pull_crsp_sample(data_dir=DATA_DIR):

"""

Pull CRSP daily stock data with comprehensive filtering for common stock universe.

This function implements the equivalent of legacy CRSP filters:

- shrcd = 10 or 11 (common stock)

- exchcd = 1, 2, or 3 (NYSE, AMEX, NASDAQ)

Filters applied:

1. Date range: 2019-2025

2. Common stock universe:

- sharetype = 'NS' (New Shares)

- securitytype = 'EQTY' (Equity)

- securitysubtype = 'COM' (Common Stock)

- usincflg = 'Y' (US Incorporated)

- issuertype IN ('ACOR', 'CORP') (Accordion or Corporate)

3. Exchange and trading filters:

- primaryexch IN ('N', 'A', 'Q') (NYSE, AMEX, NASDAQ)

- conditionaltype = 'RW' (Regular Way trading)

- tradingstatusflg = 'A' (Active trading status)

Caching:

- Data is cached locally as a parquet file to avoid repeated WRDS queries

- If cached data exists, it loads from disk instead of querying WRDS

- If no cache exists, queries WRDS and saves the result for future use

Args:

data_dir: Directory to store/load cached data

Returns:

DataFrame: Filtered CRSP daily stock data

"""

data_path = data_dir / "crsp_dsf_v2_example.parquet"

if data_path.exists():

df = pd.read_parquet(data_path)

else:

df = db.raw_sql(query, date_cols=["dlycaldt"])

df.to_parquet(data_path)

return df

df = pull_crsp_sample()

df.head()

| permno | permco | dlycaldt | issuertype | securitytype | securitysubtype | sharetype | usincflg | primaryexch | conditionaltype | ... | dlyretx | dlyreti | dlyorddivamt | dlynonorddivamt | shrout | dlyprc | ticker | securitynm | sprtrn | vwretd | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 10026 | 7976 | 2019-01-02 | CORP | EQTY | COM | NS | Y | Q | RW | ... | -0.024829 | 0.0 | 0.0 | 0.0 | 18774 | 141.0 | JJSF | J & J SNACK FOODS CORP; COM NONE; CONS | 0.001269 | 0.001796 |

| 1 | 10028 | 7978 | 2019-01-02 | CORP | EQTY | COM | NS | Y | A | RW | ... | -0.043488 | 0.0 | 0.0 | 0.0 | 26924 | 0.4399 | DGSE | D G S E COMPANIES INC; COM NONE; CONS | 0.001269 | 0.001796 |

| 2 | 10032 | 7980 | 2019-01-02 | CORP | EQTY | COM | NS | Y | Q | RW | ... | 0.012921 | 0.0 | 0.0 | 0.0 | 30992 | 51.74 | PLXS | PLEXUS CORP; COM NONE; CONS | 0.001269 | 0.001796 |

| 3 | 10044 | 7992 | 2019-01-02 | CORP | EQTY | COM | NS | Y | Q | RW | ... | 0.012887 | 0.0 | 0.0 | 0.0 | 5949 | 8.63 | RMCF | ROCKY MOUNTAIN CHOC FAC INC NEW; COM NONE; CONS | 0.001269 | 0.001796 |

| 4 | 10051 | 7999 | 2019-01-02 | CORP | EQTY | COM | NS | Y | N | RW | ... | -0.003694 | 0.0 | 0.0 | 0.0 | 36848 | 18.88 | HNGR | HANGER INC; COM NONE; CONS | 0.001269 | 0.001796 |

5 rows × 22 columns

df.info()

<class 'pandas.core.frame.DataFrame'>

Index: 5981476 entries, 0 to 481475

Data columns (total 22 columns):

# Column Dtype

--- ------ -----

0 permno Int64

1 permco Int64

2 dlycaldt datetime64[ns]

3 issuertype string

4 securitytype string

5 securitysubtype string

6 sharetype string

7 usincflg string

8 primaryexch string

9 conditionaltype string

10 tradingstatusflg string

11 dlyret Float64

12 dlyretx Float64

13 dlyreti Float64

14 dlyorddivamt Float64

15 dlynonorddivamt Float64

16 shrout Int64

17 dlyprc Float64

18 ticker string

19 securitynm string

20 sprtrn Float64

21 vwretd Float64

dtypes: Float64(8), Int64(3), datetime64[ns](1), string(10)

memory usage: 1.1 GB

Data Summary and Exploration#

Let’s look at some summary statistics to understand our dataset.

# Let's look at some summary statistics

print("\n=== Data Summary ===")

print(f"Date range: {df['dlycaldt'].min()} to {df['dlycaldt'].max()}")

print(f"Number of unique stocks: {df['permno'].nunique()}")

print(f"Total observations: {len(df)}")

=== Data Summary ===

Date range: 2019-01-02 00:00:00 to 2024-12-31 00:00:00

Number of unique stocks: 5488

Total observations: 5981476

Identifying Well-Known Stocks#

We’ll look for stocks with recognizable tickers and good data coverage for our analysis.

# Let's identify some well-known stocks for analysis

# We'll look for stocks with recognizable tickers and good data coverage

stock_summary = df.groupby(['permno', 'ticker', 'securitynm']).agg({

'dlycaldt': ['count', 'min', 'max'],

'dlyret': 'count',

'dlyorddivamt': lambda x: (x > 0).sum()

}).round(2)

stock_summary.columns = ['obs_count', 'start_date', 'end_date', 'return_obs', 'dividend_days']

stock_summary = stock_summary.reset_index()

# Filter for stocks with good data coverage and recognizable names

good_stocks = stock_summary[

(stock_summary['obs_count'] > 500) & # At least 500 observations

(stock_summary['ticker'].notna()) & # Has a ticker

(stock_summary['ticker'] != '') # Ticker is not empty

].sort_values('obs_count', ascending=False)

print("\n=== Top Stocks by Data Coverage ===")

good_stocks.head(20)

=== Top Stocks by Data Coverage ===

| permno | ticker | securitynm | obs_count | start_date | end_date | return_obs | dividend_days | |

|---|---|---|---|---|---|---|---|---|

| 4193 | 32651 | HL | HECLA MINING CO; COM NONE; CONS | 1526 | 2019-01-02 | 2024-12-31 | 1526 | 40.0 |

| 1624 | 17743 | WRB | BERKLEY W R CORP; COM NONE; CONS | 1520 | 2019-01-02 | 2024-12-31 | 1520 | 35.0 |

| 1240 | 16437 | CWH | CAMPING WORLD HOLDINGS INC; COM A; CONS | 1520 | 2019-01-02 | 2024-12-31 | 1520 | 34.0 |

| 1004 | 15540 | RILY | B RILEY FINANCIAL INC; COM NONE; CONS | 1519 | 2019-01-02 | 2024-12-31 | 1519 | 31.0 |

| 401 | 13641 | FANG | DIAMONDBACK ENERGY INC; COM NONE; CONS | 1519 | 2019-01-02 | 2024-12-31 | 1519 | 33.0 |

| 4195 | 32707 | HP | HELMERICH & PAYNE INC; COM NONE; CONS | 1518 | 2019-01-02 | 2024-12-31 | 1518 | 32.0 |

| 4337 | 47626 | CNA | C N A FINANCIAL CORP; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 4697 | 76266 | PRK | PARK NATIONAL CORP; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 4863 | 78211 | UVE | UNIVERSAL INSURANCE HOLDINGS INC; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 70 | 10901 | ITIC | INVESTORS TITLE CO; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 4040 | 25129 | CBSH | COMMERCE BANCSHARES INC; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 4817 | 77584 | BKE | BUCKLE INC; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 28.0 |

| 439 | 13802 | APAM | ARTISAN PARTNERS ASSET MGMT INC; COM A; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 4556 | 65294 | RLI | R L I CORP; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 30.0 |

| 427 | 13766 | BCC | BOISE CASCADE CO; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 32.0 |

| 4208 | 34497 | NPK | NATIONAL PRESTO INDS INC; COM NONE; CONS | 1516 | 2019-01-02 | 2024-12-31 | 1516 | 12.0 |

| 5677 | 88341 | HWBK | HAWTHORN BANCSHARES INC; COM NONE; CONS | 1515 | 2019-01-02 | 2024-12-31 | 1515 | 29.0 |

| 5640 | 87725 | IIIN | INSTEEL INDUSTRIES INC; COM NONE; CONS | 1515 | 2019-01-02 | 2024-12-31 | 1515 | 29.0 |

| 168 | 12189 | HIFS | HINGHAM INSTITUTION FOR SVGS MA; COM NONE; CONS | 1515 | 2019-01-02 | 2024-12-31 | 1515 | 29.0 |

| 5582 | 87137 | DVN | DEVON ENERGY CORP NEW; COM NONE; CONS | 1515 | 2019-01-02 | 2024-12-31 | 1515 | 30.0 |

Selecting Stocks for Analysis#

Let’s select three stocks for analysis:

A dividend-paying stock (likely a utility or financial)

A growth stock that pays no dividends (likely tech)

A stock in between

# Let's look for some specific well-known stocks

target_tickers = ['AAPL', 'MSFT', 'JNJ', 'PG', 'KO', 'XOM', 'JPM', 'WMT', 'NVDA', 'TSLA']

available_stocks = good_stocks[good_stocks['ticker'].isin(target_tickers)]

print("\n=== Available Target Stocks ===")

available_stocks

=== Available Target Stocks ===

| permno | ticker | securitynm | obs_count | start_date | end_date | return_obs | dividend_days | |

|---|---|---|---|---|---|---|---|---|

| 3375 | 22111 | JNJ | JOHNSON & JOHNSON; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 4430 | 55976 | WMT | WALMART INC; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 4344 | 47896 | JPM | JPMORGAN CHASE & CO; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 5516 | 86580 | NVDA | NVIDIA CORP; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 6450 | 93436 | TSLA | TESLA INC; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 0.0 |

| 141 | 11850 | XOM | EXXON MOBIL CORP; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 682 | 14593 | AAPL | APPLE INC; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 1792 | 18163 | PG | PROCTER & GAMBLE CO; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 91 | 11308 | KO | COCA COLA CO; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

| 8 | 10107 | MSFT | MICROSOFT CORP; COM NONE; CONS | 1510 | 2019-01-02 | 2024-12-31 | 1510 | 24.0 |

# Select three stocks for analysis

selected_stocks = ['AAPL', 'JNJ', 'TSLA'] # Apple (tech, some dividends), J&J (dividend payer), Tesla (no dividends)

# Filter data for selected stocks and market

selected_data = df[df['ticker'].isin(selected_stocks)].copy()

market_data = df[['dlycaldt', 'sprtrn', 'vwretd']].drop_duplicates().copy()

Data Quality Check#

Let’s verify our data quality and check for any duplicate entries.

# Debug: Check for duplicate dates in selected data

print(f"\n=== Data Quality Check ===")

print(f"Selected stocks data shape: {selected_data.shape}")

print(f"Duplicate ticker-date combinations: {selected_data.duplicated(subset=['ticker', 'dlycaldt']).sum()}")

print(f"Market data shape: {market_data.shape}")

print(f"Duplicate dates in market data: {market_data.duplicated(subset=['dlycaldt']).sum()}")

# Show sample of selected data

print(f"\nSample of selected data:")

print(selected_data[['ticker', 'dlycaldt', 'dlyret']].head(10))

=== Data Quality Check ===

Selected stocks data shape: (4530, 22)

Duplicate ticker-date combinations: 0

Market data shape: (1510, 3)

Duplicate dates in market data: 0

Sample of selected data:

ticker dlycaldt dlyret

568 AAPL 2019-01-02 0.001141

1537 JNJ 2019-01-02 -0.010074

3592 TSLA 2019-01-02 -0.068149

4161 AAPL 2019-01-03 -0.099607

5129 JNJ 2019-01-03 -0.01589

7184 TSLA 2019-01-03 -0.031472

7754 AAPL 2019-01-04 0.042689

8721 JNJ 2019-01-04 0.016783

10776 TSLA 2019-01-04 0.057697

11345 AAPL 2019-01-07 -0.002226

Calculating Cumulative Returns#

Now let’s calculate cumulative returns for our selected stocks to analyze their performance over time.

def calculate_cumulative_returns(data, return_col='dlyret'):

"""Calculate cumulative returns for each stock"""

data = data.copy()

data = data.sort_values(['ticker', 'dlycaldt'])

# Handle potential duplicate dates by taking the last observation for each ticker-date combination

data = data.drop_duplicates(subset=['ticker', 'dlycaldt'], keep='last')

# Calculate cumulative returns (1 + return) for each stock using a safer approach

data['cumret'] = 1.0 # Initialize with 1

for ticker in data['ticker'].unique():

mask = data['ticker'] == ticker

returns = data.loc[mask, return_col].fillna(0)

cumulative = (1 + returns).cumprod()

data.loc[mask, 'cumret'] = cumulative

return data

# Calculate cumulative returns

stock_cumret = calculate_cumulative_returns(selected_data)

market_cumret = market_data.copy()

market_cumret['cumret'] = (1 + market_cumret['sprtrn']).cumprod()

Plot 1: Matplotlib - Cumulative Returns Comparison#

Let’s start with a traditional matplotlib plot to visualize the cumulative returns.

# Plot 1: Matplotlib - Cumulative Returns Comparison

plt.figure(figsize=(12, 8))

plt.style.use('seaborn-v0_8')

for ticker in selected_stocks:

ticker_data = stock_cumret[stock_cumret['ticker'] == ticker]

plt.plot(ticker_data['dlycaldt'], ticker_data['cumret'],

label=ticker, linewidth=2, marker='o', markersize=3)

# Add market portfolio

plt.plot(market_cumret['dlycaldt'], market_cumret['cumret'],

label='S&P 500', linewidth=3, color='black', linestyle='--')

plt.title('Cumulative Returns Comparison (2019-2025)', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Cumulative Return (1 = $1 invested)', fontsize=12)

plt.legend(fontsize=11, frameon=True, fancybox=True, shadow=True)

plt.grid(True, alpha=0.3)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

Plot 2: Seaborn - Cumulative Returns with Better Styling#

Now let’s use Seaborn for enhanced styling and aesthetics.

# Plot 2: Seaborn - Cumulative Returns with better styling

plt.figure(figsize=(12, 8))

sns.set_style("whitegrid")

sns.set_palette("husl")

# Prepare data for seaborn

plot_data = []

for ticker in selected_stocks:

ticker_data = stock_cumret[stock_cumret['ticker'] == ticker][['dlycaldt', 'cumret']]

ticker_data['ticker'] = ticker

plot_data.append(ticker_data)

# Add market data

market_plot_data = market_cumret[['dlycaldt', 'cumret']].copy()

market_plot_data['ticker'] = 'S&P 500'

plot_data.append(market_plot_data)

plot_df = pd.concat(plot_data, ignore_index=True)

sns.lineplot(data=plot_df, x='dlycaldt', y='cumret', hue='ticker',

linewidth=2, markers=True, markersize=4)

plt.title('Cumulative Returns: Selected Stocks vs S&P 500', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Cumulative Return', fontsize=12)

plt.legend(title='Asset', fontsize=11)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

Plot 3: Plotly Express - Interactive Cumulative Returns#

Finally, let’s create an interactive plot using Plotly Express for enhanced user experience.

# Plot 3: Plotly Express - Interactive Cumulative Returns

fig = px.line(plot_df, x='dlycaldt', y='cumret', color='ticker',

title='Interactive Cumulative Returns Comparison',

labels={'dlycaldt': 'Date', 'cumret': 'Cumulative Return', 'ticker': 'Asset'},

line_shape='linear', render_mode='svg')

fig.update_layout(

title_font_size=16,

xaxis_title_font_size=12,

yaxis_title_font_size=12,

legend_title_font_size=12,

hovermode='x unified'

)

fig.show()

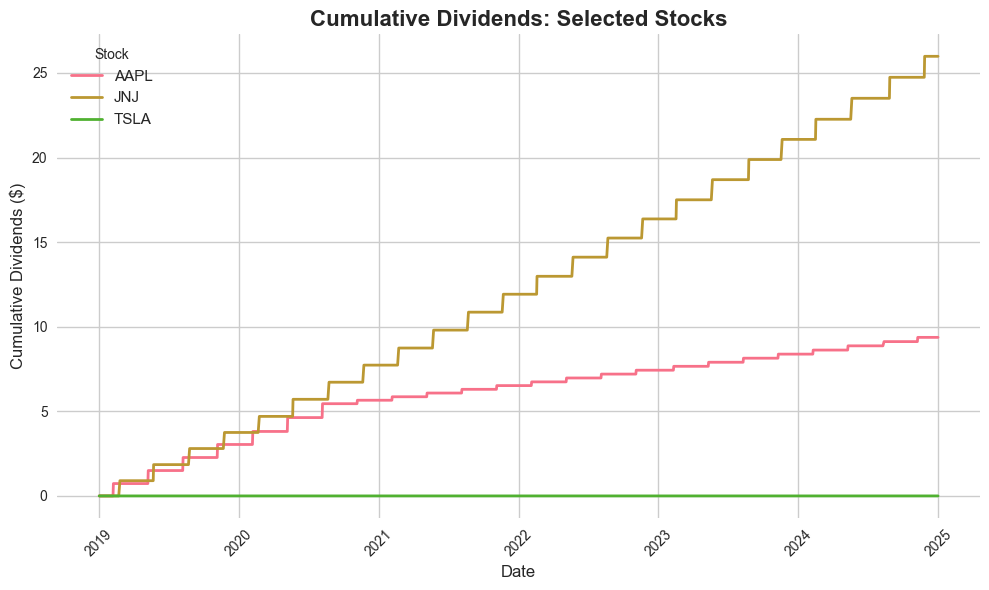

Dividend Analysis#

Now let’s analyze dividends to understand the income component of our selected stocks.

# Now let's analyze dividends

print("\n=== Dividend Analysis ===")

=== Dividend Analysis ===

def calculate_cumulative_dividends(data):

"""Calculate cumulative dividends for each stock"""

data = data.copy()

data = data.sort_values(['ticker', 'dlycaldt'])

# Handle potential duplicate dates by taking the last observation for each ticker-date combination

data = data.drop_duplicates(subset=['ticker', 'dlycaldt'], keep='last')

# Sum up all dividend amounts (ordinary + non-ordinary)

data['total_div'] = data['dlyorddivamt'].fillna(0) + data['dlynonorddivamt'].fillna(0)

# Calculate cumulative dividends using a safer approach

data['cumdiv'] = 0.0 # Initialize with 0

for ticker in data['ticker'].unique():

mask = data['ticker'] == ticker

dividends = data.loc[mask, 'total_div']

cumulative = dividends.cumsum()

data.loc[mask, 'cumdiv'] = cumulative

return data

# Calculate cumulative dividends

stock_cumdiv = calculate_cumulative_dividends(selected_data)

# Get dividend summary

div_summary = stock_cumdiv.groupby('ticker').agg({

'total_div': ['sum', 'count'],

'cumdiv': 'max'

}).round(4)

div_summary.columns = ['total_dividends', 'dividend_days', 'cumulative_dividends']

print(div_summary)

total_dividends dividend_days cumulative_dividends

ticker

AAPL 9.37 1510 9.37

JNJ 25.98 1510 25.98

TSLA 0.0 1510 0.00

Plot 4: Matplotlib - Cumulative Dividends#

Let’s visualize the cumulative dividends using matplotlib.

# Plot 4: Matplotlib - Cumulative Dividends

plt.figure(figsize=(12, 8))

for ticker in selected_stocks:

ticker_data = stock_cumdiv[stock_cumdiv['ticker'] == ticker]

plt.plot(ticker_data['dlycaldt'], ticker_data['cumdiv'],

label=f'{ticker} (Total: ${ticker_data["cumdiv"].max():.2f})',

linewidth=2, marker='s', markersize=3)

plt.title('Cumulative Dividends Paid (2019-2025)', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Cumulative Dividends ($)', fontsize=12)

plt.legend(fontsize=11, frameon=True, fancybox=True, shadow=True)

plt.grid(True, alpha=0.3)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

Plot 5: Seaborn - Dividend Comparison#

Now let’s use Seaborn for the dividend visualization.

# Plot 5: Seaborn - Dividend Comparison

plt.figure(figsize=(10, 6))

sns.set_style("whitegrid")

# Prepare dividend data for seaborn

div_plot_data = []

for ticker in selected_stocks:

ticker_data = stock_cumdiv[stock_cumdiv['ticker'] == ticker][['dlycaldt', 'cumdiv']]

ticker_data['ticker'] = ticker

div_plot_data.append(ticker_data)

div_plot_df = pd.concat(div_plot_data, ignore_index=True)

sns.lineplot(data=div_plot_df, x='dlycaldt', y='cumdiv', hue='ticker',

linewidth=2, markers=True, markersize=4)

plt.title('Cumulative Dividends: Selected Stocks', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Cumulative Dividends ($)', fontsize=12)

plt.legend(title='Stock', fontsize=11)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

Plot 6: Plotly Express - Interactive Dividends#

Let’s create an interactive dividend plot with Plotly.

# Plot 6: Plotly Express - Interactive Dividends

fig = px.line(div_plot_df, x='dlycaldt', y='cumdiv', color='ticker',

title='Interactive Cumulative Dividends',

labels={'dlycaldt': 'Date', 'cumdiv': 'Cumulative Dividends ($)', 'ticker': 'Stock'},

line_shape='linear', render_mode='svg')

fig.update_layout(

title_font_size=16,

xaxis_title_font_size=12,

yaxis_title_font_size=12,

legend_title_font_size=12,

hovermode='x unified'

)

fig.show()

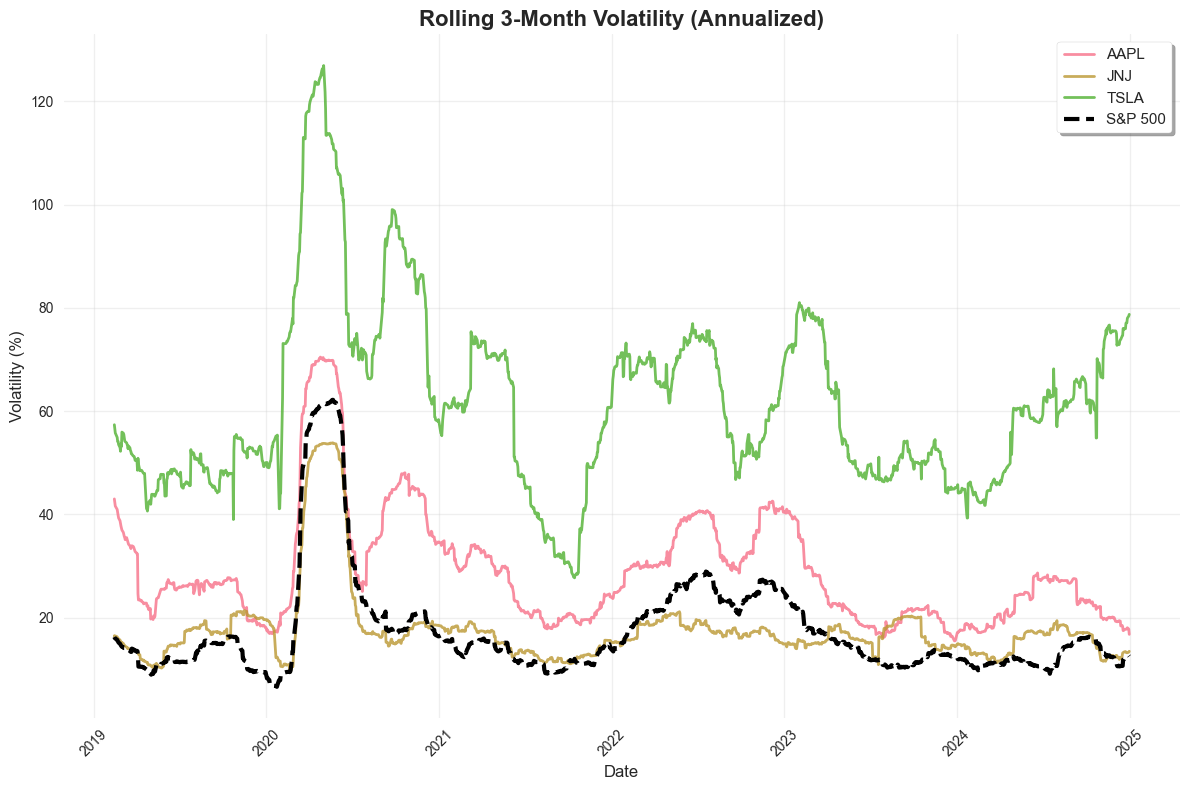

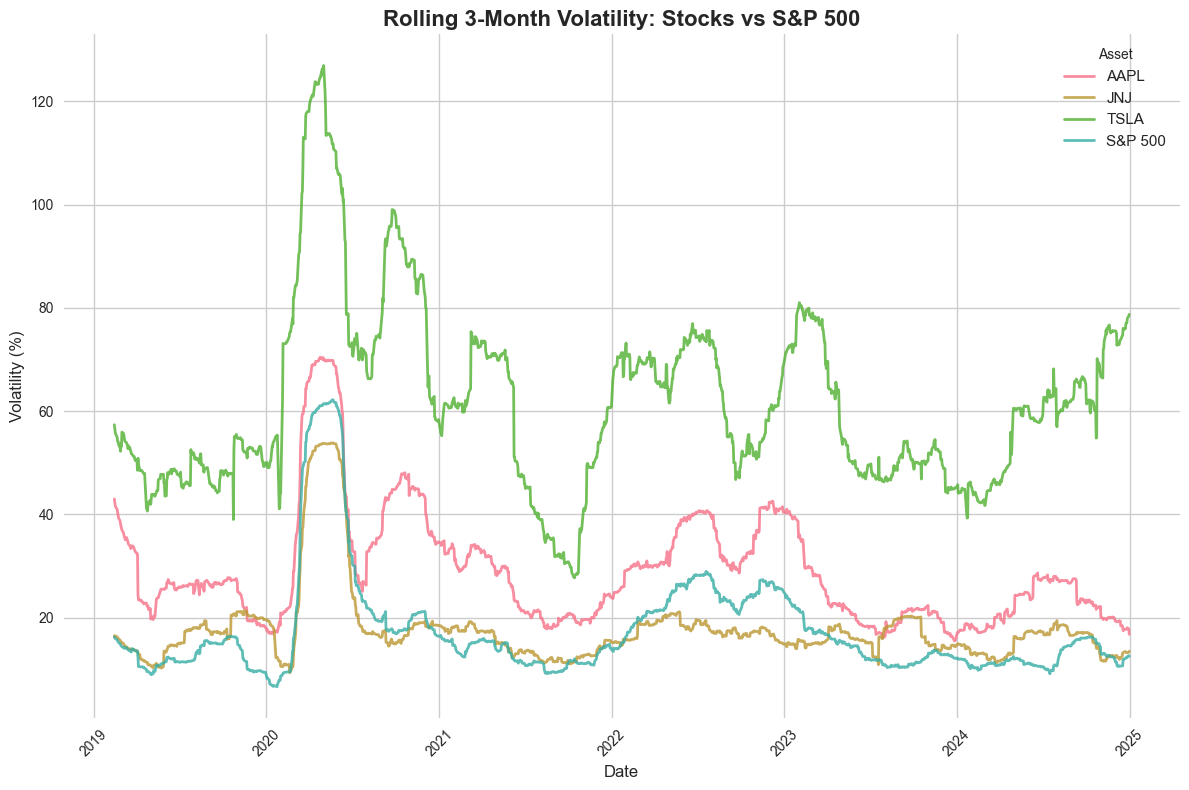

Rolling Volatility Analysis#

Now let’s analyze the rolling volatility of our selected stocks to understand their risk characteristics over time.

# Now let's calculate rolling volatility (3-month window)

print("\n=== Rolling Volatility Analysis ===")

=== Rolling Volatility Analysis ===

def calculate_rolling_volatility(data, window_days=63): # ~3 months (63 trading days)

"""Calculate rolling volatility for each stock"""

data = data.copy()

data = data.sort_values(['ticker', 'dlycaldt'])

# Handle potential duplicate dates by taking the last observation for each ticker-date combination

data = data.drop_duplicates(subset=['ticker', 'dlycaldt'], keep='last')

# Calculate rolling standard deviation of returns using a safer approach

data['rolling_vol'] = np.nan

data['rolling_vol_annual'] = np.nan

for ticker in data['ticker'].unique():

mask = data['ticker'] == ticker

returns = data.loc[mask, 'dlyret'].fillna(0)

# Calculate rolling standard deviation

rolling_std = returns.rolling(window=window_days, min_periods=30).std()

data.loc[mask, 'rolling_vol'] = rolling_std

# Annualize volatility (multiply by sqrt(252) for daily data)

data.loc[mask, 'rolling_vol_annual'] = rolling_std * np.sqrt(252)

return data

# Calculate rolling volatility for stocks

stock_vol = calculate_rolling_volatility(selected_data)

# Calculate rolling volatility for market

market_vol = market_data.copy()

market_vol['rolling_vol'] = market_vol['sprtrn'].rolling(

window=63, min_periods=30

).std()

market_vol['rolling_vol_annual'] = market_vol['rolling_vol'] * np.sqrt(252)

Plot 7: Matplotlib - Rolling Volatility#

Let’s visualize the rolling volatility using matplotlib.

# Plot 7: Matplotlib - Rolling Volatility

plt.figure(figsize=(12, 8))

for ticker in selected_stocks:

ticker_data = stock_vol[stock_vol['ticker'] == ticker]

plt.plot(ticker_data['dlycaldt'], ticker_data['rolling_vol_annual'] * 100,

label=ticker, linewidth=2, alpha=0.8)

# Add market volatility

plt.plot(market_vol['dlycaldt'], market_vol['rolling_vol_annual'] * 100,

label='S&P 500', linewidth=3, color='black', linestyle='--')

plt.title('Rolling 3-Month Volatility (Annualized)', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Volatility (%)', fontsize=12)

plt.legend(fontsize=11, frameon=True, fancybox=True, shadow=True)

plt.grid(True, alpha=0.3)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

Plot 8: Seaborn - Volatility Comparison#

Now let’s use Seaborn for the volatility visualization.

# Plot 8: Seaborn - Volatility Comparison

plt.figure(figsize=(12, 8))

sns.set_style("whitegrid")

# Prepare volatility data for seaborn

vol_plot_data = []

for ticker in selected_stocks:

ticker_data = stock_vol[stock_vol['ticker'] == ticker][['dlycaldt', 'rolling_vol_annual']]

ticker_data['ticker'] = ticker

vol_plot_data.append(ticker_data)

# Add market volatility

market_vol_data = market_vol[['dlycaldt', 'rolling_vol_annual']].copy()

market_vol_data['ticker'] = 'S&P 500'

vol_plot_data.append(market_vol_data)

vol_plot_df = pd.concat(vol_plot_data, ignore_index=True)

vol_plot_df['rolling_vol_annual'] = vol_plot_df['rolling_vol_annual'] * 100 # Convert to percentage

sns.lineplot(data=vol_plot_df, x='dlycaldt', y='rolling_vol_annual', hue='ticker',

linewidth=2, alpha=0.8)

plt.title('Rolling 3-Month Volatility: Stocks vs S&P 500', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Volatility (%)', fontsize=12)

plt.legend(title='Asset', fontsize=11)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

Plot 9: Plotly Express - Interactive Volatility#

Finally, let’s create an interactive volatility plot with Plotly.

# Plot 9: Plotly Express - Interactive Volatility

fig = px.line(vol_plot_df, x='dlycaldt', y='rolling_vol_annual', color='ticker',

title='Interactive Rolling Volatility Analysis',

labels={'dlycaldt': 'Date', 'rolling_vol_annual': 'Volatility (%)', 'ticker': 'Asset'},

line_shape='linear', render_mode='svg')

fig.update_layout(

title_font_size=16,

xaxis_title_font_size=12,

yaxis_title_font_size=12,

legend_title_font_size=12,

hovermode='x unified'

)

fig.show()

Summary Statistics#

Let’s compile a comprehensive summary of our analysis results.

# Summary statistics

print("\n=== Summary Statistics ===")

print("Cumulative Returns (as of latest date):")

for ticker in selected_stocks:

latest_ret = stock_cumret[stock_cumret['ticker'] == ticker]['cumret'].iloc[-1]

print(f"{ticker}: {latest_ret:.2f}x")

latest_market_ret = market_cumret['cumret'].iloc[-1]

print(f"S&P 500: {latest_market_ret:.2f}x")

print("\nTotal Dividends Paid:")

for ticker in selected_stocks:

total_div = stock_cumdiv[stock_cumdiv['ticker'] == ticker]['cumdiv'].iloc[-1]

print(f"{ticker}: ${total_div:.2f}")

print("\nAverage Annualized Volatility (3-month rolling):")

for ticker in selected_stocks:

avg_vol = stock_vol[stock_vol['ticker'] == ticker]['rolling_vol_annual'].mean() * 100

print(f"{ticker}: {avg_vol:.1f}%")

avg_market_vol = market_vol['rolling_vol_annual'].mean() * 100

print(f"S&P 500: {avg_market_vol:.1f}%")

=== Summary Statistics ===

Cumulative Returns (as of latest date):

AAPL: 6.65x

JNJ: 1.32x

TSLA: 18.20x

S&P 500: 2.35x

Total Dividends Paid:

AAPL: $9.37

JNJ: $25.98

TSLA: $0.00

Average Annualized Volatility (3-month rolling):

AAPL: 29.0%

JNJ: 17.7%

TSLA: 61.6%

S&P 500: 17.5%

Analysis Complete#

This script demonstrates:

Matplotlib plotting with pyplot interface

Seaborn plotting with enhanced styling

Plotly Express for interactive visualizations

Cumulative return analysis for selected stocks vs S&P 500

Dividend analysis comparing dividend-paying vs non-dividend stocks

Rolling volatility analysis using 3-month windows

The analysis provides insights into:

Performance comparison between different types of stocks

Income generation through dividends

Risk characteristics over time

Interactive visualization capabilities for data exploration “””

print(“\n=== Analysis Complete ===”) print(“This script demonstrates:”) print(“1. Matplotlib plotting with pyplot interface”) print(“2. Seaborn plotting with enhanced styling”) print(“3. Plotly Express for interactive visualizations”) print(“4. Cumulative return analysis for selected stocks vs S&P 500”) print(“5. Dividend analysis comparing dividend-paying vs non-dividend stocks”) print(“6. Rolling volatility analysis using 3-month windows”)