Data Module Integration Tests#

This notebook provides integration tests for the finm.data module by:

Pulling each data source

Creating simple visualizations

Calculating factor exposures for asset return data

Data Sources:

Factor Data: Fama-French 3 factors, Federal Reserve yield curve, He-Kelly-Manela factors

Asset Returns: Open Source Bond (treasury and corporate returns)

import os

from pathlib import Path

import matplotlib.pyplot as plt

import pandas as pd

from dotenv import load_dotenv

import finm

from finm.data import fama_french, federal_reserve, he_kelly_manela, open_source_bond

load_dotenv()

DATA_DIR = Path(os.environ.get("DATA_DIR", "./_data"))

DATA_DIR.mkdir(parents=True, exist_ok=True)

print(f"Data directory: {DATA_DIR}")

Data directory: /Users/jbejarano/GitRepositories/finm/_data

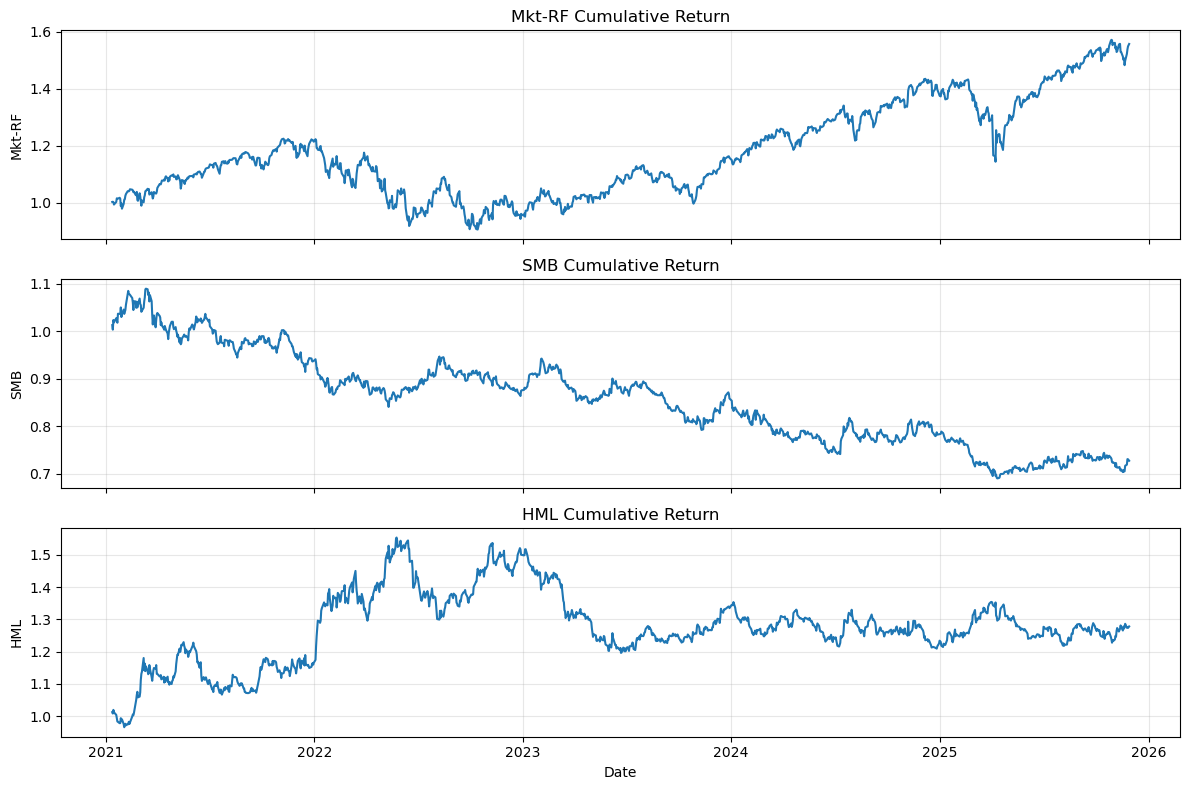

1. Fama-French Factors#

The Fama-French 3-factor model provides:

Mkt-RF: Market excess return

SMB: Small Minus Big (size factor)

HML: High Minus Low (value factor)

RF: Risk-free rate

# Load Fama-French data from bundled data (data_dir=None)

ff_factors = fama_french.load(

data_dir=None,

).to_pandas()

ff_factors = ff_factors.set_index("Date")

print(f"Loaded Fama-French factors (converted to pandas DataFrame)")

print(f"\nFama-French factors shape: {ff_factors.shape}")

print(f"Columns: {ff_factors.columns}")

ff_factors.head()

Loaded Fama-French factors (converted to pandas DataFrame)

Fama-French factors shape: (1227, 4)

Columns: Index(['Mkt-RF', 'SMB', 'HML', 'RF'], dtype='object')

| Mkt-RF | SMB | HML | RF | |

|---|---|---|---|---|

| Date | ||||

| 2021-01-12 | 0.0037 | 0.0128 | 0.0124 | 0.0 |

| 2021-01-13 | 0.0006 | -0.0094 | -0.0045 | 0.0 |

| 2021-01-14 | -0.0012 | 0.0202 | 0.0113 | 0.0 |

| 2021-01-15 | -0.0086 | -0.0050 | -0.0074 | 0.0 |

| 2021-01-19 | 0.0092 | 0.0088 | -0.0079 | 0.0 |

# Plot Fama-French factors

fig, axes = plt.subplots(3, 1, figsize=(12, 8), sharex=True)

# Cumulative returns for each factor

for ax, factor in zip(axes, ["Mkt-RF", "SMB", "HML"]):

cumulative = (1 + ff_factors[factor]).cumprod()

ax.plot(cumulative.index, cumulative.values)

ax.set_ylabel(factor)

ax.set_title(f"{factor} Cumulative Return")

ax.grid(True, alpha=0.3)

plt.xlabel("Date")

plt.tight_layout()

plt.show()

# Summary statistics

print("\nFama-French Factor Statistics (Daily):")

print(ff_factors[["Mkt-RF", "SMB", "HML", "RF"]].describe())

Fama-French Factor Statistics (Daily):

Mkt-RF SMB HML RF

count 1227.000000 1227.000000 1227.000000 1227.000000

mean 0.000424 -0.000233 0.000245 0.000129

std 0.011242 0.007336 0.009452 0.000092

min -0.059200 -0.027000 -0.038900 0.000000

25% -0.005150 -0.005200 -0.005500 0.000000

50% 0.000500 -0.000500 -0.000100 0.000200

75% 0.006600 0.004200 0.005800 0.000200

max 0.096500 0.036100 0.037100 0.000200

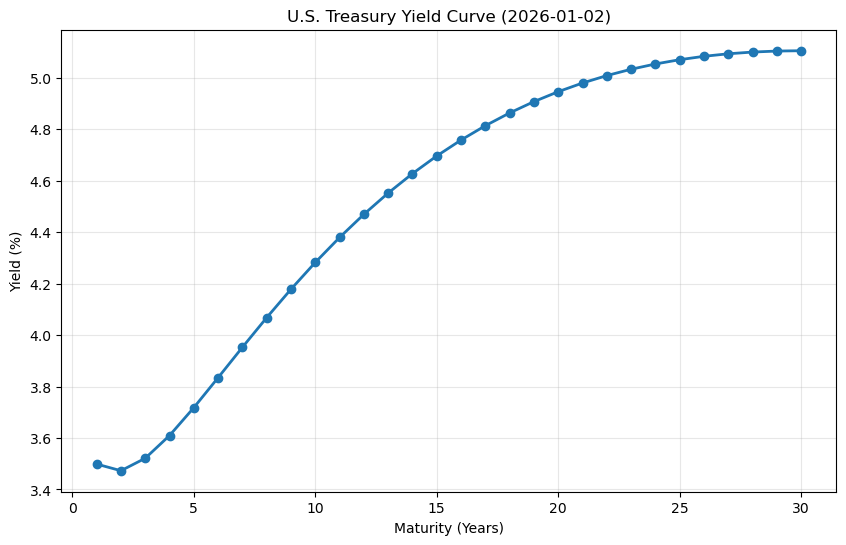

2. Federal Reserve Yield Curve#

The GSW (Gurkaynak, Sack, Wright) yield curve provides:

Zero-coupon yields for maturities 1-30 years

Nelson-Siegel-Svensson model parameters

Note: These are yields, not returns.

# Load Federal Reserve yield curve data with auto-pull

yields = federal_reserve.load(

data_dir=DATA_DIR,

variant="standard",

pull_if_not_found=True,

accept_license=True,

).to_pandas()

yields = yields.set_index("Date")

print(f"Yield curve shape: {yields.shape}")

print(f"Columns: {yields.columns}")

yields.head()

Yield curve shape: (16843, 30)

Columns: Index(['SVENY01', 'SVENY02', 'SVENY03', 'SVENY04', 'SVENY05', 'SVENY06',

'SVENY07', 'SVENY08', 'SVENY09', 'SVENY10', 'SVENY11', 'SVENY12',

'SVENY13', 'SVENY14', 'SVENY15', 'SVENY16', 'SVENY17', 'SVENY18',

'SVENY19', 'SVENY20', 'SVENY21', 'SVENY22', 'SVENY23', 'SVENY24',

'SVENY25', 'SVENY26', 'SVENY27', 'SVENY28', 'SVENY29', 'SVENY30'],

dtype='object')

| SVENY01 | SVENY02 | SVENY03 | SVENY04 | SVENY05 | SVENY06 | SVENY07 | SVENY08 | SVENY09 | SVENY10 | ... | SVENY21 | SVENY22 | SVENY23 | SVENY24 | SVENY25 | SVENY26 | SVENY27 | SVENY28 | SVENY29 | SVENY30 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||||||||

| 1961-06-14 | 2.9825 | 3.3771 | 3.5530 | 3.6439 | 3.6987 | 3.7351 | 3.7612 | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1961-06-15 | 2.9941 | 3.4137 | 3.5981 | 3.6930 | 3.7501 | 3.7882 | 3.8154 | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1961-06-16 | 3.0012 | 3.4142 | 3.5994 | 3.6953 | 3.7531 | 3.7917 | 3.8192 | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1961-06-19 | 2.9949 | 3.4386 | 3.6252 | 3.7199 | 3.7768 | 3.8147 | 3.8418 | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1961-06-20 | 2.9833 | 3.4101 | 3.5986 | 3.6952 | 3.7533 | 3.7921 | 3.8198 | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

5 rows × 30 columns

# Plot yield curve snapshot for the most recent date

latest_date = yields.index.max()

latest_yields = yields.loc[latest_date]

maturities = [int(col.replace("SVENY", "")) for col in latest_yields.index]

plt.figure(figsize=(10, 6))

plt.plot(maturities, latest_yields.values, "o-", linewidth=2, markersize=6)

plt.xlabel("Maturity (Years)")

plt.ylabel("Yield (%)")

plt.title(f"U.S. Treasury Yield Curve ({latest_date.strftime('%Y-%m-%d')})")

plt.grid(True, alpha=0.3)

plt.show()

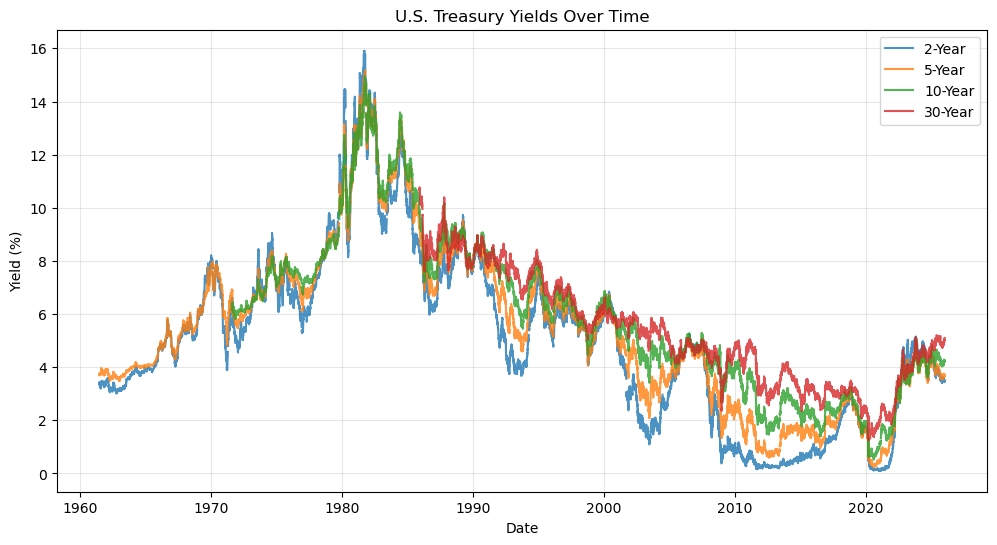

# Plot time series of key maturities

key_maturities = ["SVENY02", "SVENY05", "SVENY10", "SVENY30"]

labels = ["2-Year", "5-Year", "10-Year", "30-Year"]

plt.figure(figsize=(12, 6))

for col, label in zip(key_maturities, labels):

if col in yields.columns:

plt.plot(yields.index, yields[col], label=label, alpha=0.8)

plt.xlabel("Date")

plt.ylabel("Yield (%)")

plt.title("U.S. Treasury Yields Over Time")

plt.legend()

plt.grid(True, alpha=0.3)

plt.show()

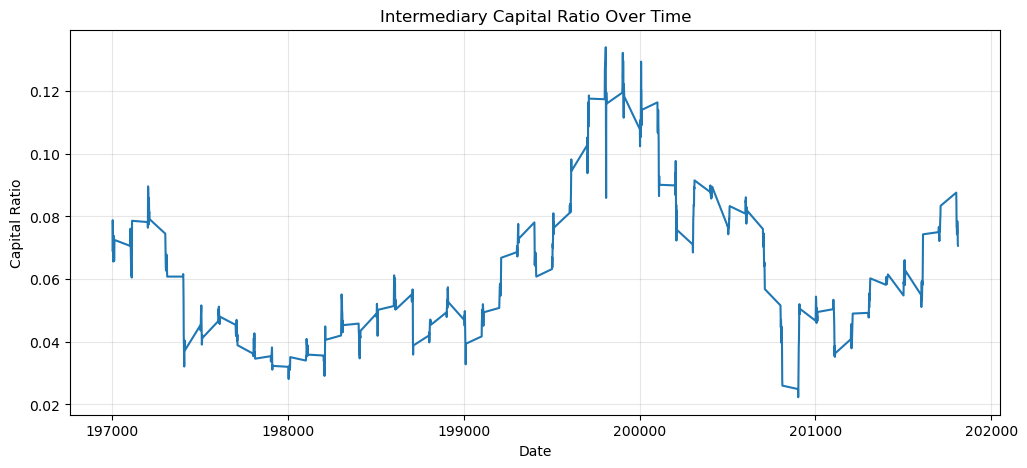

3. He-Kelly-Manela Intermediary Factors#

The HKM factors capture:

Intermediary capital ratio: Capital of financial intermediaries

Intermediary capital risk factor: Innovation in capital ratio

Note: These are factors, not asset returns.

# Load He-Kelly-Manela data with auto-pull

hkm_monthly = he_kelly_manela.load(

data_dir=DATA_DIR,

variant="factors_monthly",

pull_if_not_found=True,

accept_license=True,

).to_pandas()

hkm_monthly = hkm_monthly.set_index("yyyymm")

print(f"HKM monthly factors shape: {hkm_monthly.shape}")

print(f"Columns: {hkm_monthly.columns}")

hkm_monthly.head()

HKM monthly factors shape: (587, 5)

Columns: Index(['intermediary_capital_ratio', 'intermediary_capital_risk_factor',

'intermediary_value_weighted_investment_return',

'intermediary_leverage_ratio_squared', 'date'],

dtype='object')

| intermediary_capital_ratio | intermediary_capital_risk_factor | intermediary_value_weighted_investment_return | intermediary_leverage_ratio_squared | date | |

|---|---|---|---|---|---|

| yyyymm | |||||

| 197001 | 0.0691 | -0.0727 | -0.0960 | 209.1790 | 1970-01-01 |

| 197002 | 0.0788 | 0.1416 | 0.1486 | 161.1352 | 1970-02-01 |

| 197003 | 0.0756 | -0.0360 | -0.0088 | 174.8429 | 1970-03-01 |

| 197004 | 0.0688 | -0.0870 | -0.1050 | 211.3283 | 1970-04-01 |

| 197005 | 0.0656 | -0.0440 | -0.0469 | 232.2706 | 1970-05-01 |

# Plot intermediary capital ratio

if "intermediary_capital_ratio" in hkm_monthly.columns:

plt.figure(figsize=(12, 5))

plt.plot(hkm_monthly.index, hkm_monthly["intermediary_capital_ratio"])

plt.xlabel("Date")

plt.ylabel("Capital Ratio")

plt.title("Intermediary Capital Ratio Over Time")

plt.grid(True, alpha=0.3)

plt.show()

elif "capital_ratio" in hkm_monthly.columns:

plt.figure(figsize=(12, 5))

plt.plot(hkm_monthly.index, hkm_monthly["capital_ratio"])

plt.xlabel("Date")

plt.ylabel("Capital Ratio")

plt.title("Intermediary Capital Ratio Over Time")

plt.grid(True, alpha=0.3)

plt.show()

else:

print("Available columns:", list(hkm_monthly.columns))

4. Open Source Bond Returns#

The Open Bond Asset Pricing project provides:

Treasury bond returns: Government bond returns

Corporate bond monthly returns: Monthly returns with 108 factor signals

Corporate bond daily prices: Daily prices from TRACE Stage 1

These are asset returns that can be used for factor analysis.

# Load treasury returns with auto-pull if not found locally

treasury = open_source_bond.load(

data_dir=DATA_DIR,

variant="treasury",

pull_if_not_found=True,

accept_license=True,

).to_pandas()

print(f"Treasury returns shape: {treasury.shape}")

print(f"Treasury columns: {list(treasury.columns[:10])}...")

Treasury returns shape: (2381340, 5)

Treasury columns: ['DATE', 'CUSIP', 'tr_return', 'tr_ytm_match', 'tau']...

# Load corporate bond returns (monthly with factor signals) with auto-pull

corporate = open_source_bond.load(

data_dir=DATA_DIR,

variant="corporate_monthly",

pull_if_not_found=True,

accept_license=True,

).to_pandas()

print(f"Corporate returns shape: {corporate.shape}")

print(f"Corporate columns: {list(corporate.columns[:10])}...")

corporate.head()

Corporate returns shape: (1859546, 140)

Corporate columns: ['cusip', 'date', 'issuer_cusip', 'permno', 'permco', 'gvkey', '144a', 'country', 'call', 'ret_vw']...

| cusip | date | issuer_cusip | permno | permco | gvkey | 144a | country | call | ret_vw | ... | imom1 | imom3_1 | imom12_1 | iltr48_12 | iltr30_6 | iltr24_3 | var_90 | es_90 | var_95 | str | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 000336AE7 | 2002-08-31 | 000336 | 75188.0 | NaN | NaN | 0 | USA | 1 | 0.007252 | ... | 0.009089 | 0.016714 | 0.070078 | 0.259947 | 0.250910 | 0.202824 | 0.032174 | 0.035203 | 0.038233 | 0.051041 |

| 1 | 000336AE7 | 2002-09-30 | 000336 | 75188.0 | NaN | NaN | 0 | USA | 1 | -0.054660 | ... | 0.015736 | 0.024968 | 0.075254 | 0.263304 | 0.213676 | 0.196803 | 0.038233 | 0.046446 | 0.054660 | -0.002936 |

| 2 | 000336AE7 | 2002-10-31 | 000336 | 75188.0 | NaN | NaN | 0 | USA | 1 | 0.051999 | ... | 0.014274 | 0.030234 | 0.067641 | 0.295979 | 0.237394 | 0.206790 | 0.038233 | 0.046446 | 0.054660 | 0.066941 |

| 3 | 000336AE7 | 2002-11-30 | 000336 | 75188.0 | NaN | NaN | 0 | USA | 1 | 0.080557 | ... | 0.001263 | 0.015555 | 0.075689 | 0.260612 | 0.262213 | 0.207362 | 0.038233 | 0.046446 | 0.054660 | 0.045280 |

| 4 | 000336AE7 | 2003-04-30 | 000336 | 75188.0 | NaN | NaN | 0 | USA | 1 | 0.067899 | ... | 0.005471 | 0.018439 | 0.120662 | 0.257004 | 0.244847 | 0.196972 | 0.038233 | 0.046446 | 0.054660 | 0.053730 |

5 rows × 140 columns

# Plot treasury returns if available

if "bond_ret" in treasury.columns:

# Aggregate treasury returns

treasury_agg = treasury.groupby("date")["bond_ret"].mean()

plt.figure(figsize=(12, 5))

cumulative = (1 + treasury_agg).cumprod()

plt.plot(cumulative.index, cumulative.values)

plt.xlabel("Date")

plt.ylabel("Cumulative Return")

plt.title("Average Treasury Bond Cumulative Returns")

plt.grid(True, alpha=0.3)

plt.show()

elif "ret" in treasury.columns:

treasury_agg = treasury.groupby("date")["ret"].mean()

plt.figure(figsize=(12, 5))

cumulative = (1 + treasury_agg).cumprod()

plt.plot(cumulative.index, cumulative.values)

plt.xlabel("Date")

plt.ylabel("Cumulative Return")

plt.title("Average Treasury Bond Cumulative Returns")

plt.grid(True, alpha=0.3)

plt.show()

else:

print("Treasury columns:", list(treasury.columns))

Treasury columns: ['DATE', 'CUSIP', 'tr_return', 'tr_ytm_match', 'tau']

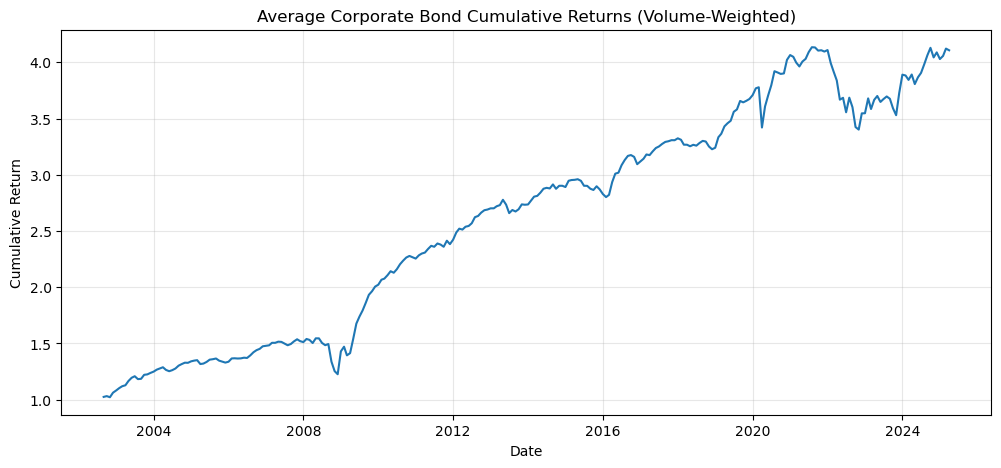

# Plot corporate bond returns

# Note: Monthly corporate data uses ret_vw (volume-weighted total return)

ret_col = "ret_vw" if "ret_vw" in corporate.columns else "bond_ret"

if ret_col in corporate.columns:

# Aggregate corporate returns by date (equal-weighted across bonds)

corp_agg = corporate.groupby("date")[ret_col].mean()

plt.figure(figsize=(12, 5))

cumulative = (1 + corp_agg.dropna()).cumprod()

plt.plot(cumulative.index, cumulative.values)

plt.xlabel("Date")

plt.ylabel("Cumulative Return")

plt.title("Average Corporate Bond Cumulative Returns (Volume-Weighted)")

plt.grid(True, alpha=0.3)

plt.show()

else:

print("Corporate columns:", list(corporate.columns))

5. Factor Analysis (Asset Returns Only)#

We calculate factor exposures for bond returns against the Fama-French factors. This analysis only applies to asset return data (Open Source Bond), not to yields (Federal Reserve) or factor data (HKM).

# Prepare Fama-French factors for merging

# Resample to monthly if needed for bond data

ff_monthly = ff_factors.resample("ME").last()

print(f"Monthly FF factors shape: {ff_monthly.shape}")

Monthly FF factors shape: (59, 4)

# Calculate factor exposures for corporate bonds

# Note: Monthly corporate data uses ret_vw (volume-weighted total return)

corp_ret_col = "ret_vw" if "ret_vw" in corporate.columns else "bond_ret"

if corp_ret_col in corporate.columns and "date" in corporate.columns:

# Aggregate corporate returns by date (equal-weighted portfolio)

corp_monthly = corporate.groupby("date")[corp_ret_col].mean()

corp_monthly.index = pd.to_datetime(corp_monthly.index)

# Resample to month-end to align with FF factors

corp_monthly = corp_monthly.resample("ME").mean()

# Calculate factor exposures

exposures_corp = finm.calculate_factor_exposures(

corp_monthly,

ff_monthly,

annualization_factor=12.0, # Monthly data

)

print("\nCorporate Bond Factor Exposures:")

print("-" * 40)

for key, value in exposures_corp.items():

print(f" {key}: {value:.4f}")

Corporate Bond Factor Exposures:

----------------------------------------

average_return: 0.0052

volatility: 0.0755

sharpe_ratio: 0.0511

market_beta: 1.0169

smb_beta: -1.3948

hml_beta: 0.0425

# Calculate factor exposures for treasury bonds

if "bond_ret" in treasury.columns:

# Aggregate treasury returns by date

treas_monthly = treasury.groupby("date")["bond_ret"].mean()

treas_monthly.index = pd.to_datetime(treas_monthly.index)

treas_monthly = treas_monthly.resample("ME").mean()

exposures_treas = finm.calculate_factor_exposures(

treas_monthly, ff_monthly, annualization_factor=12.0

)

print("\nTreasury Bond Factor Exposures:")

print("-" * 40)

for key, value in exposures_treas.items():

print(f" {key}: {value:.4f}")

elif "ret" in treasury.columns:

treas_monthly = treasury.groupby("date")["ret"].mean()

treas_monthly.index = pd.to_datetime(treas_monthly.index)

treas_monthly = treas_monthly.resample("ME").mean()

exposures_treas = finm.calculate_factor_exposures(

treas_monthly, ff_monthly, annualization_factor=12.0

)

print("\nTreasury Bond Factor Exposures:")

print("-" * 40)

for key, value in exposures_treas.items():

print(f" {key}: {value:.4f}")

# Summary comparison table

if "exposures_corp" in dir() and "exposures_treas" in dir():

summary = pd.DataFrame(

{

"Corporate Bonds": exposures_corp,

"Treasury Bonds": exposures_treas,

}

).T

print("\nFactor Exposure Comparison:")

print("=" * 60)

print(summary.to_string())

6. WRDS Data (Optional)#

WRDS data requires authentication. This section is skipped if credentials are not available.

# Check for WRDS credentials

WRDS_USERNAME = os.environ.get("WRDS_USERNAME", "")

if WRDS_USERNAME:

print(f"WRDS username found: {WRDS_USERNAME}")

print("WRDS data pull is available but skipped in this notebook.")

print("To pull WRDS data, use:")

print(" from finm.data import wrds")

print(

" wrds.pull(data_dir=DATA_DIR, variant='treasury', wrds_username=WRDS_USERNAME)"

)

else:

print("WRDS credentials not found.")

print("To use WRDS data, set the WRDS_USERNAME environment variable:")

print(" export WRDS_USERNAME=your_username")

print("Or add to your .env file:")

print(" WRDS_USERNAME=your_username")

WRDS username found: jmbejara

WRDS data pull is available but skipped in this notebook.

To pull WRDS data, use:

from finm.data import wrds

wrds.pull(data_dir=DATA_DIR, variant='treasury', wrds_username=WRDS_USERNAME)

Summary#

This notebook demonstrated:

Fama-French Factors: Loaded and visualized the 3-factor model data

Federal Reserve Yield Curve: Downloaded GSW yields and plotted the term structure

He-Kelly-Manela Factors: Pulled intermediary capital factor data

Open Source Bond Returns: Downloaded treasury and corporate bond returns

Factor Analysis: Calculated factor exposures for bond returns

All data sources follow the standardized interface:

pull(data_dir, accept_license=True): Download data from sourceload(data_dir, variant, pull_if_not_found, accept_license): Load cached data (returns polars DataFrame)to_long_format(df): Convert to long format

Note: When using pull_if_not_found=True, you must also set accept_license=True

to acknowledge the data provider’s licensing terms. See each module’s LICENSE_INFO for details.